Wired for Growth: How Infrastructure Became the Backbone of the AI Economy

Simon Turner

Mon 3 Nov 2025 7 minutesWith markets looking frothy, demand for defensive investments is rising. Global listed infrastructure is arguably one of the more compelling opportunities fit for these times. Not because it’s flashy or in vogue, but because data-networks, electricity grids, toll-roads and communication towers underpin the digital economy and the decarbonisation of the global economy.

The upshot is global infrastructure offers two imperatives of genuinely defensive investments: income reliability in an uncertain environment, and exposure to secular growth drivers as the AI rollout, data-consumption growth, and the energy transition accelerate.

The Attractions of Infrastructure

Magellan Investment Partners’ 2025 Investor Letter provides one of the better descriptions of the attractions of infrastructure as an asset class:

‘Infrastructure’s core purpose in investor portfolios is to enhance risk-adjusted returns by providing diversification and wealth protection in challenging market conditions. Moreover, we view this resilience not as luck, but as the natural outcome of owning assets whose cash flows are underwritten by regulation, long-term contracts and indispensable demand. Not everything that calls itself “infrastructure” earns a place in our universe. We maintain a strict definition and screen out businesses exposed to commodity prices, material competition or significant sovereign risk. What remains – predominantly regulated utilities, toll road and airport concessions, contracted energy networks and communications towers – has historically produced predictable, inflation-linked earnings through recessions and shocks.’

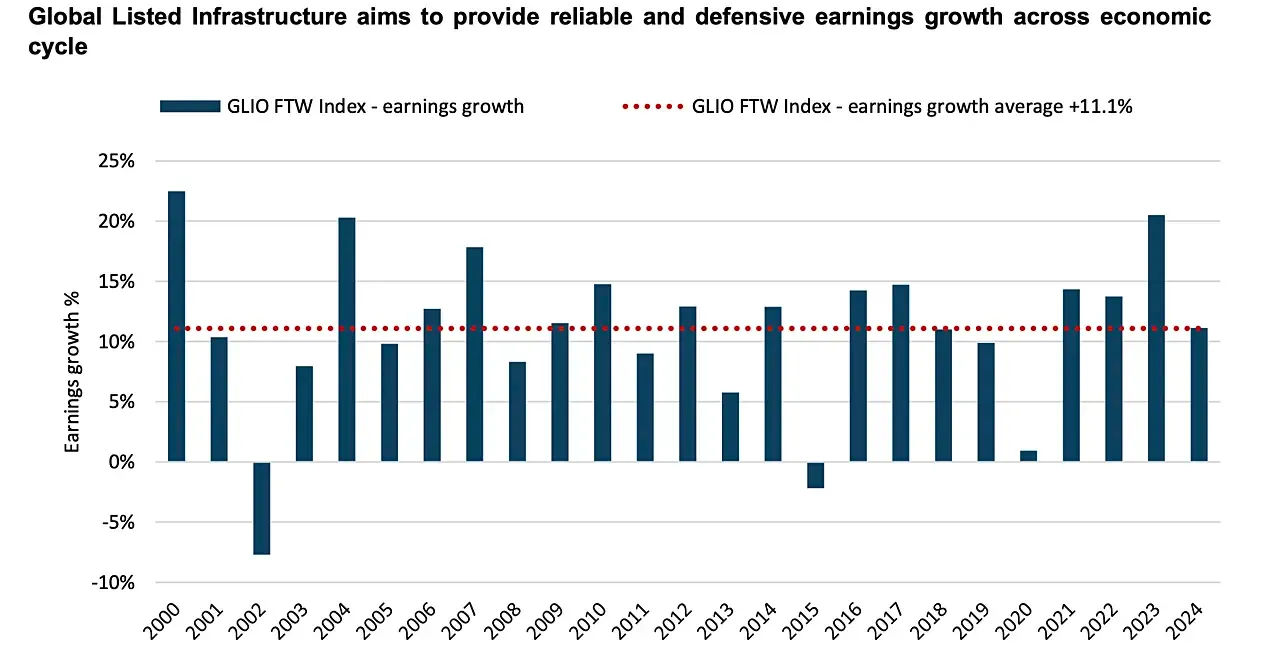

It’s those predictable, inflation-linked earnings through recessions and shocks that defensive investors are so focused on. As shown below, the infrastructure sector’s earnings growth track record has been consistent through a range of global economic environments.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Everyday Infrastructure = Opportunity

Whilst Nvidia has captured the market’s obsession with all things AI, infrastructure is also firmly exposed to this structural growth thematic.

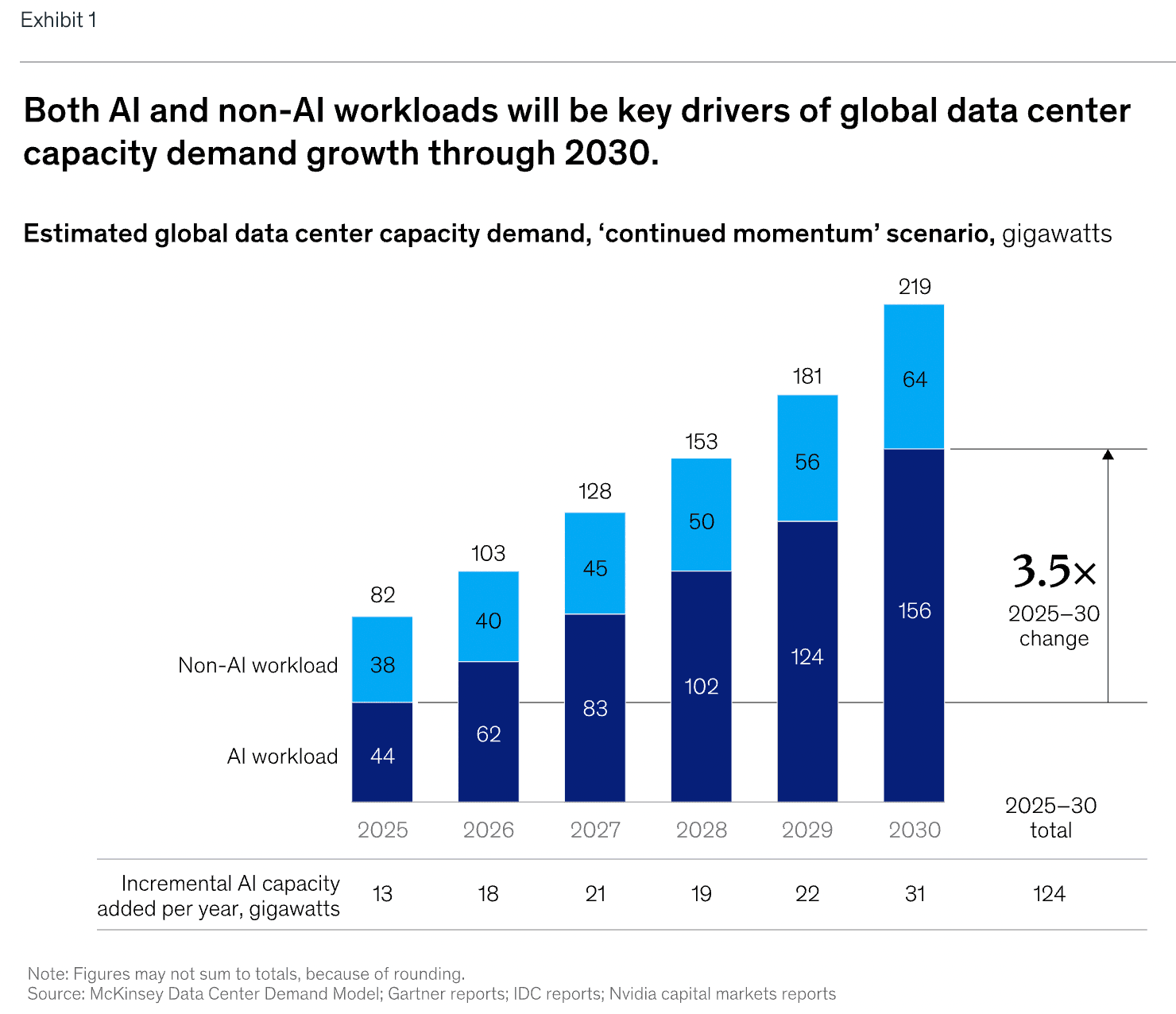

It’s all about electricity demand.

Growth in AI usage and advanced computing are driving stronger electricity demand growth, which is placing further demands on the capacity and reliability of existing power systems. This is pushing policymakers around the world to support investment in electricity transmission and distribution, as well as other energy infrastructure.

Meanwhile, decarbonisation and grid-upgrade capex present another important long-term runway for the sector. As Magellan recently pointed out: ‘For advanced economies, the clean-energy investment share of total energy investment rose from 58.6 % in 2016-20 to 70.3 % in 2021-25. In 2025, global clean-energy investment is expected to reach US$2.2 trillion—double the US$1.1 trillion projected for fossil-fuel investment.’

These are not isolated mega-themes. They directly feed into the cash-flow profile of utilities, grid-owners, communications infrastructure and transport concessions. Crucially for investors, they do so via regulated assets or monopolistic structures with minimal exposure to competition. That leads to the type of predictable, inflation-linked earnings that is positioned to deliver through recessions and market wobbles. Hence, infrastructure is a uniquely defensive asset class.

Income You Can Rely On, Growth You Can Believe In

Importantly, infrastructure income is largely protected from inflation. Regulators or contractual agreements typically allow price-escalation in response to rising costs, while the asset base itself is usually growing through capex. So in a market environment where yield-now is often chased at the risk of duration and credit, infrastructure offers uniquely protected income streams underpinned by long-dated real-asset investments.

While infrastructure was once pigeon-holed as primarily an income-generating asset class, most infrastructure funds are also testament to the sector’s capital growth potential. For example, Magellan’s Global Listed Infrastructure Fund has generated a 9.5% p.a. return over the past three years of which 3.8% p.a. was income. This performance was achieved across a diversified portfolio exposed to the above-mentioned secular growth opportunities.

Portfolio Benefits Beyond Yield & Growth

Income plus growth is a great start for any investment opportunity. But what makes infrastructure particularly useful at a portfolio level are its diversification benefits and low correlation to equities and bonds.

The upshot is enhanced risk-adjusted returns, particularly during challenging market conditions when defensive investments are expected to earn their place in a portfolio.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Cycle has Turned

Right now, the timing for investing in infrastructure appears compelling.

For much of 2020-23, infrastructure valuations were challenged by rising real interest rates and inflationary pressures. Infrastructure stocks tend to carry a reasonable amount of debt, so higher real interest rates had a negative impact on sector valuations.

But now, with global rate expectations stabilising and the secular growth themes gathering pace, the environment appears increasingly favourable for the asset class.

Investor Tips

Here are a few tips to be aware of when investing in global infrastructure funds:

👉 Strong Long-Term Track Record

Look for specialist infrastructure funds with a strong track record over the long-term, preferably including during the global financial crisis and its aftermath when genuinely defensive investments should have been outperforming.

👉 Check Fund Size & Liquidity

The larger infrastructure funds tend to offer better liquidity options for investors. They are also able to allocate a portion of their funds to unlisted assets to access the higher potential valuation upsides on offer in the private markets.

👉 Check Fund Fees

Whilst infrastructure is a niche asset class which is arguably well suited to active management, make sure you’re not overpaying. Most specialist active funds in the sector are charging an annual management fee of 1-1.5% p.a.

👉 Think About Currency Hedging

Given infrastructure tends to be a global asset class, it’s important to consider your currency exposure.

In general, if you’re bullish on the Australian dollar, you’ll gravitate towards currency hedged funds like Magellan’s Infrastructure Fund, while if you’re bearish, unhedged funds are likely to be a better match. And if in doubt, currency hedging generally makes sense to ensure currency is not an unconscious risk.

👉 Keep a Close Eye on Debt.

Higher real interest rates are arguably the biggest sector risk to be aware of looking forward. Stick with infrastructure funds which invest in relatively lowly geared stocks to ensure this risk is mitigated.

👉 Think Long Term

Finally, infrastructure is not a short-term trade. It is best suited for a 7-10-year+ view. Thinking long term is a superpower in this sector.

Playing Offense on a Defensive Pitch

Global listed infrastructure is no longer a niche add-on for yield-hungry portfolios. It has evolved into a core defensive allocation for investors seeking a combination of income, growth, and diversification.

So when you next ask yourself ‘how can I up my portfolio’s defensive attributes while still participating in the structural growth typical of mega-themes?’, the answer may not be found not in speculative land-plots or tech stocks, but in the power-lines, fibre-optics, and toll-roads ensuring the real world functions as it should.

An Infrastructure Fund Worth Checking Out

Learn More About Infrastructure at Our Upcoming Event…

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.