Contrarius Global Equity Fund

The Fund employs Contrarius’ valuation-based, contrarian investment philosophy and aims to achieve long-term returns higher than the benchmark, without greater risk of loss.

The Fund employs Contrarius’ valuation-based, contrarian investment philosophy and aims to achieve long-term returns higher than the benchmark, without greater risk of loss.

The Fund aims to outperform the Benchmark over the investment cycle (typically 5-7years).

Vanguard Global Minimum Volatility Active ETF seeks to provide long-term capital appreciation through an active management approach with volatility lower than the FTSE Global All Cap Index (AUD Hedged), before taking into account fees, expenses and tax.

The investment objective of the Fund is to provide long-term capital growth by gaining exposure to a diversified portfolio of large Value Companies associated with approved developed markets (excluding Australia).

The fund aims to provide investors with the performance of the MSCI Japan Index, before fees and expenses. The index is designed to measure the performance of Japanese large & mid-capitalisation companies.

Cordis Global Medical Technology Fund is an Australian unit trust of actively-managed global listed companies which design and manufacture medical devices to treat critical chronic diseases.

The Fund aims to achieve a long-term total return (before fees and expenses) that exceeds the MSCI World ex Australia Index, in $A unhedged with net dividends reinvested (Benchmark)

BCOM invests in a highly liquid, broad-based basket of commodities, including energy, grains, precious metals, industrial metals, softs and livestock.

The Fund invests in a concentrated portfolio of listed global equity securities designed to deliver compound risk-adjusted returns while preserving capital over the long-term. The Fund also has the capacity to short sell securities that GCQ believes to be vulnerable to material price declines. The Fund invests in listed securities.

The fund aims to provide investors with the performance of the S&P Global 1200 Consumer Staples Sector IndexTM, before fees and expenses. The index is designed to measure the performance of global consumer staples companies and may include large-, mid- or small-capitalisation stocks.

DRIV aims to track the performance of an index (before fees and expenses) that provides exposure to a portfolio of global companies at the forefront of innovation in automotive technology.

The Fund aims to provide investors with the performance of the MSCI World Ex Australia Custom ESG Leaders Index, before fees and expenses. The index is designed to measure the performance of global, developed market large and mid- capitalisation companies with better sustainability credentials relative to their sector peers.

DRUG aims to track the performance of an index (before fees and expenses) that comprises the largest global healthcare companies (ex-Australia), hedged into Australian dollars.

Vanguard Diversified Balanced Index ETF seeks to track the weighted average return of the various indices of the Underlying Funds in which it invests, in proportion to the Strategic Asset Allocation, before taking into account fees, expenses and tax.

The Fund aims to provide investors with the performance of the various indices of the Underlying Funds in which the Fund invests, in proportion to a ‘Balanced’ long term Strategic Asset Allocation (SAA), before fees and expenses, of approximately 50% equities and 50% fixed income exposure.

Discover everything you need to know about Global Large Cap Equity Funds, their diversification and growth potential, associated risks, and how to invest through various fund structures, including ETFs and managed funds.

A Global Large Cap Equity Fund is an investment fund that pools money from many investors to buy shares in large international companies, typically valued above $10 billion, listed on major stock exchanges like the NYSE and NASDAQ. These funds offer diversified exposure to global markets and are popular for their growth and income potential.

These funds offer diversified exposure to international companies such as Apple, Microsoft, and NVIDIA. They are managed by professional fund managers, or by passively tracking global indices like the MSCI World Index. Global Large Cap Equity Funds aim to achieve long-term capital appreciation and dividend income from their portfolios of global equities.

Global Large Cap Equity Funds are popular with Australian investors due to the diversification they offer across geographies, sectors, and currencies. These funds provide access to some of the world’s largest and most successful companies that often aren’t available on the Australian Securities Exchange. By way of background, the MSCI World Index comprises around 1,500 companies across 23 developed countries with Australian companies comprising only 2% of its market capitalisation.

So investing globally allows Australian investors to tap into high-growth sectors such as technology and healthcare, which are underrepresented locally. Additionally, currency diversification can act as a hedge against domestic economic fluctuations. Overall, these funds help Australian investors reduce their portfolio risk while generating enhanced risk-adjusted returns.

What are the key terms to know when investing in global large cap equity funds?

Here are essential definitions to help you get started with global large cap equity investing:

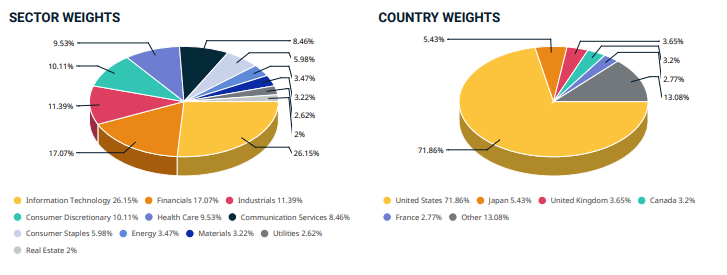

The global equity market spans major developed economies, with the MSCI World Index as its primary benchmark, covering around 1,500 stocks across 23 countries. Sector-wise, Information Technology makes up 25% of the MSCI World Index, followed by Financials at 17%, and Industrials at 11%—as shown below.

Other mainstream global indices include S&P Global 100, which focuses on multinational leaders, and MSCI World ex-Australia, which excludes Australian companies from a broader global portfolio. Regional indices also track the North American, European, and Asia-Pacific markets.

Four primary factors influence the performance of global large cap equity markets:

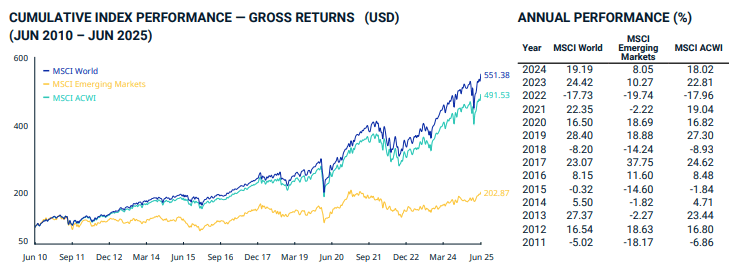

The MSCI World Index has delivered solid historical returns of 14.7% p.a. over the past five years driven primarily by the technology and consumer sectors—as shown below.

Looking forward, ‘Firetrail believes the economic backdrop for 2025 supports a positive outlook for global equities. Lower inflation, a steady labour market, and favourable monetary policy conditions provide a solid foundation for growth. If central banks continue to adjust interest rates by moving them lower, equity markets could benefit from both increased stability and investor confidence. Gains, however, could be tempered by investment risks in 2025.’

According to J.P. Morgan:

‘The central equity theme for 2025 is one of higher dispersion across stocks, styles, sectors, countries and themes. This should improve the opportunity set and provide a healthier backdrop for the active management industry after consecutive quarters of record narrow and unhealthy equity leadership.’

There are five main types of global large cap equity funds, each offering different strategies, risk levels, and ways to access global markets:

According to Betashares:

‘Currency hedged ETFs offer Australian investors the ability to choose an international investment exposure that seeks to remove currency fluctuations from the equation or where they are of the view that currency movements will have a negative impact on the value of their exposure.’

The main differences between global equity ETFs and managed funds for Australians include:

According to Passive Income Australia:

‘In managed funds, the entire fund is one pool of assets, so other investors selling their units triggers capital gains for all investors of the fund. So even if you don’t sell any units, you still have to realise gains. This doesn’t occur with ETFs due to their tax structure, and instead, you defer these capital gains until you sell your ETF shares.’

Summary:

ETFs offer lower fees, intraday trading, and higher transparency, making them accessible and convenient. Managed funds suit investors seeking professional management, often with higher minimums and less frequent trading.

There are five main benefits of investing in Global Large Cap Funds to be aware of:

Geographic Diversification & Market Access

Global large cap funds give investors exposure beyond Australia, tapping into 98% of the global equity market. This diversification reduces country-specific risk and provides access to sectors, like technology, that are underrepresented on the ASX. Investors can own shares in leading global companies such as Apple and Microsoft.

Exposure to the World’s Largest Companies

These funds invest in dominant, globally recognised firms with strong balance sheets and diverse revenue streams. Such companies tend to be more resilient during downturns and offer potential for long-term growth.

Technology & Innovation Exposure

Global funds give access to key growth sectors, especially technology, automation, artificial intelligence (AI), and cybersecurity, that drive global market performance but are less available in the Australian market.

Currency Diversification

Investing overseas, particularly in unhedged funds, offers currency diversification. Australian investors may benefit if the Australian dollar (AUD) weakens, boosting global returns in AUD terms.

Professional Management & Research

Global funds are run by experienced managers with access to institutional research and global expertise, helping investors make informed decisions and access opportunities usually unavailable to individual investors.

Liquidity & Accessibility

Global large cap ETFs are traded on the ASX, providing high liquidity and low entry costs. This makes it easy for Australian investors to build a diversified global portfolio without complex structures.

Global Large Cap Fund investing also involves inherent risks requiring careful consideration:

Currency Risk & Exchange Rate Volatility

Unhedged global investments are affected by foreign currency movements. If the Australian dollar rises, your overseas returns can fall, even if the underlying assets perform well. Hedged funds can help, but add costs and other risks.

Market Risk & Economic Cycles

Global markets can suffer major downturns, such as during the 2008 financial crisis. In times of global recession or high volatility, international markets often move together, limiting the benefits of diversification.

Sector & Geographic Concentration Risk

Many global funds are heavily weighted toward the U.S. market (71% of the MSCI World Index) and technology sector (25% of the MSCI World Index). This increases exposure to downturns in specific regions or sectors, despite a fund’s international label.

Regulatory & Political Risk

Investing in overseas markets exposes your portfolio to changes in foreign regulations, political events, and trade disputes. Such risks can affect global companies, especially those with complex supply chains or cross-border operations.

Tax Complexity & Withholding Taxes

International investments often face foreign withholding taxes and complex tax treatment. Australian investors may have extra reporting requirements and may not receive the same tax benefits as with local investments.

Tracking Error & Fund Manager Risk

ETFs may not exactly track their benchmarks due to fees or management techniques. Active global fund managers can also underperform their benchmarks, sometimes despite higher fees.

There are five main ways to invest in Global Large Cap Equity Funds:

For global ETFs, investors require ASX trading access through an online broker.

Popular platforms include CommSec which offers trading in global ETFs, Westpac Share Trading which provides access to 25+ international exchanges, CMC Markets with low brokerage on select global ETFs, and Stake which specialises in U.S. market access.

Key considerations when selecting a broker include brokerage fees (ranging from $0-$29.95), international market access, currency conversion costs, and research tools.

ASIC advises investors to beware of brokers marketing ‘zero’ or ‘low-cost’ brokerage to attract clients: ‘some of these claims of “zero” or “low-cost” brokerage were not true to label, particularly where other fees and charges were payable by the client or where the service was “bundled” with other products or services that effectively subsidised the brokerage and caused retail investors to take on additional risk.’

Unlisted Global Large Cap Equity Funds require direct applications through fund managers’ websites or financial advisers. For example, fund providers like Pengana and Lakehouse Capital offer investors direct access to global equity strategies. Applications typically involve completing investment forms, providing relevant identification, and meeting the minimum investment thresholds ranging between $25,000-$50,000+.

Investment platforms provide consolidated access to multiple global fund managers through single accounts, often with reduced paperwork and consolidated international reporting. These platforms typically charge additional administration fees (0.2-0.5% p.a.) but offer convenience for diversified global fund portfolios and currency management.

Financial advisers assist with global fund selection, currency hedging decisions, and international portfolio construction, which is particularly valuable for investors seeking personalised advice on geographic allocation. Adviser fees typically range between 0.5-1.5% p.a. plus potential upfront charges for any advice received.

Most superannuation funds offer global equity investment options within their investment menus, including both active and passive alternatives. Self-managed super funds (SMSFs) also provide direct access to global opportunities with potential tax advantages on offer.

Here’s what you need to know:

International dividends from global funds are usually subject to foreign withholding taxes (0–30% depending on the country and treaties).

Australian residents can typically claim foreign tax credits to avoid double taxation. Global ETFs usually provide annual tax statements with details and credits.

According to Moneysmart:

‘You pay tax on investment income at your marginal tax rate. You’re allowed tax deductions for the cost of buying, managing and selling an investment. Capital gains are taxed at your marginal rate. If you've held the investment for more than 12 months, you're only taxed on half of the capital gain. This is known as the capital gains tax (CGT) discount.

Currency-hedged funds can create foreign exchange gains or losses, which are taxed as ordinary income (not capital gains). These are usually included in your annual distribution and may require extra tax planning.

The ATO requires you to declare all foreign income on your Australian tax return. You’ll need to keep detailed records of foreign income, withholding taxes, and currency conversions.

Tip: Seek professional tax advice if you have a substantial international portfolio.

Constructing a Global Large Cap Equity Funds portfolio aligned with your investment objectives and risk tolerance requires strategic planning:

Clearly defined your investment goals helps shape the Global Large Cap Equity Funds selection process, whether through seeking diversification, targeting regions, or managing currency risk. Aligning these factors with your risk tolerance helps guide your allocation between stable developed markets and higher-growth emerging markets.

Some investors establish core holdings (often comprising 60-80% of their international allocation) in broad global market ETFs like Betashares Diversified All Growth ETF (ASX: DHHF) or JPMorgan Global Research Enhanced Index Equity Active ETF (Managed Fund) (ASX: JREG), combined with smaller satellite positions in regional, sector-specific, or thematic global funds (often a 20-40% allocation). This approach balances the benefits of international diversification with targeted exposure to preferred global themes or regions.

Strategic decisions on currency hedging depend on investors’ AUD outlook and risk tolerance, with many advisers recommending a 50/50 split between hedged and unhedged global exposure. Currency-hedged funds provide protection during AUD strength periods, while unhedged funds benefit from AUD weakness.

Diversified global portfolios balance exposure across regions (U.S., Europe, Asia-Pacific) and sectors underrepresented in Australia, particularly technology, healthcare, and consumer discretionary. Consider avoiding over-concentration in the U.S. market despite its index dominance.

Regular portfolio rebalancing maintains investors’ target allocations as different global regions and currencies outperform or underperform. Quarterly or semi-annual rebalancing captures gains from winning international positions while adding to underperforming global areas, helping to smooth a portfolio’s long-term returns.

Successful Global Large Cap Equity Fund investing requires a long-term perspective to benefit from international economic growth and the compounding of returns despite short-term volatility. Regularly reinvesting distributions and dollar cost averaging enables compounding to work effectively across global markets.

Effective monitoring ensures that Global Large Cap Equity Funds continue to align with investors’ objectives while avoiding excessive trading:

Monitoring KPIs like Total Return offers investors a comprehensive view by combining capital gains, dividends, and currency impacts. Benchmark Comparison ensures a fund’s performance aligns with or outpaces indices such as MSCI World or S&P Global 100. Evaluating currency impact helps determine how exchange rate fluctuations affect returns, particularly between hedged and unhedged fund versions.

Here are some tools to help investors monitor their portfolios:

Set a consistent review cadence. For example, annual reviews are typically sufficient for passive global strategies, while active international funds may require quarterly assessments.

Stay alert to rebalancing triggers, such as major currency fluctuations or diverging regional performance, which can distort target allocations and necessitate adjustments to maintain strategic alignment and risk balancing.

Systematic comparison enables the informed selection of Global Large Cap Equity Funds aligned with investors’ objectives:

Review Product Disclosure Statements to understand each fund’s global mandate, benchmark index (e.g. MSCI World, S&P Global 100), and investment approach. Ensure alignment with your personal goals whether that means seeking broad global diversification, focusing on specific regions, or managing currency risk. A match between a fund’s strategy and your objectives is essential for long-term success.

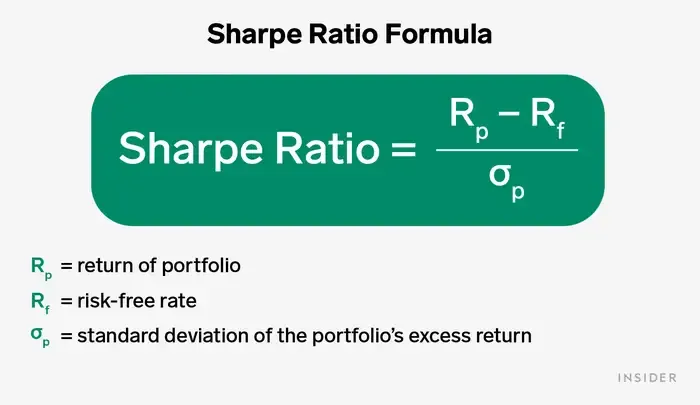

Evaluate long-term net fund returns against global benchmarks and peer funds across multiple market cycles. Focus on risk-adjusted returns and metrics like the Sharpe ratio to assess consistency and efficiency, rather than relying solely on headline returns or short-term global performance.

Compare total costs, including management expense ratios, brokerage, hedging fees, and FX spreads.

Global ETFs typically offer lower fees (0.08–0.55% p.a.) than active funds (0.75–1.50% p.a.). Lower overall costs generally enhance net returns, especially for long-term global investors, making cost analysis a critical factor in international fund selection.

Assess fund providers based on global market experience, international assets under management, and team stability with the help of platforms such as InvestmentMarkets and Morningstar. Trusted names like Perpetual and J.P. Morgan bring strengths in passive indexing, active global management, or currency expertise. Choosing a fund manager with proven global capabilities and international infrastructure can enhance trust, transparency, and long-term fund performance.

Examine top holdings, sector weights, and the number of international positions to gauge diversification. Diversified global funds should offer broad exposure across regions and industries, reducing country or sector-specific risk. Avoid funds which are overly concentrated in dominant markets like the U.S. unless that aligns with your investment goals and global outlook.

Review each fund’s currency hedging policy, associated costs, and historical hedging effectiveness. Comparing hedged versus unhedged fund returns helps gauge the impact of currency fluctuations on performance. Hedging can smooth volatility but may reduce long-term returns depending on currency trends, making this an important consideration for global investors.

Sustainable global funds apply ESG criteria to filter their international investments, thereby aligning their portfolios with ESG goals and potentially ethical considerations. These funds may exclude controversial sectors (e.g. fossil fuels, weapons) while still providing diversified global exposure. ESG funds often appeal to investors seeking performance combined with sustainability outcomes, though they may differ in geographic and sector weighting from traditional funds.

Global large cap equity funds can be a smart choice for investors seeking international diversification and exposure to the world’s largest companies beyond Australia’s small share of global markets. These funds are available in many forms, from low-cost global ETFs to actively managed funds, catering to different risk profiles and investment goals.

However, they do come with risks—including currency fluctuations, geopolitical uncertainties, and sector concentration. The right fit depends on your individual goals, risk tolerance, and desire for global diversification. To maximise success, choose funds that align with your objectives, monitor your portfolio regularly, and rebalance as markets evolve.

Tip:

Consider your investment timeline, comfort with international markets, and willingness to manage extra risks and reporting requirements before adding global large cap equity funds to your portfolio.