Looking for a way to get more from your savings?

The no fee, fixed term deposit making a positive difference to more than just your bank balance.

Looking for a way to get more from your savings?

The no fee, fixed term deposit making a positive difference to more than just your bank balance.

Term deposits are one of the simplest and most reliable investment options available to Australian investors. They involve investing money with a bank or financial institution for a fixed period, during which the funds earn a guaranteed rate of interest. This certainty makes them attractive for investors seeking stability, especially in uncertain markets. They are protected from market volatility as returns are locked in regardless of interest rate movements, whilst they also benefit from a government guarantee on deposits up to $250,000 per institution under the Financial Claims Scheme. Term deposits help investors diversify their portfolios by balancing higher-risk assets with a safe, income-generating option. For retirees, SMSFs, or conservative investors, they provide predictable cash flow, capital security, and peace of mind while still delivering competitive returns over short to medium time frames.

Prior to investing in a term deposit, it’s important that investors know how to compare term deposits to allow them to make an informed decision.

Australian investors can find the best term deposit rates by comparing offers across banks, credit unions, and online lenders, as rates can vary significantly between institutions. Comparison websites and financial platforms make it easy to check current rates side by side, filter by deposit size and term length, and discover special promotions.

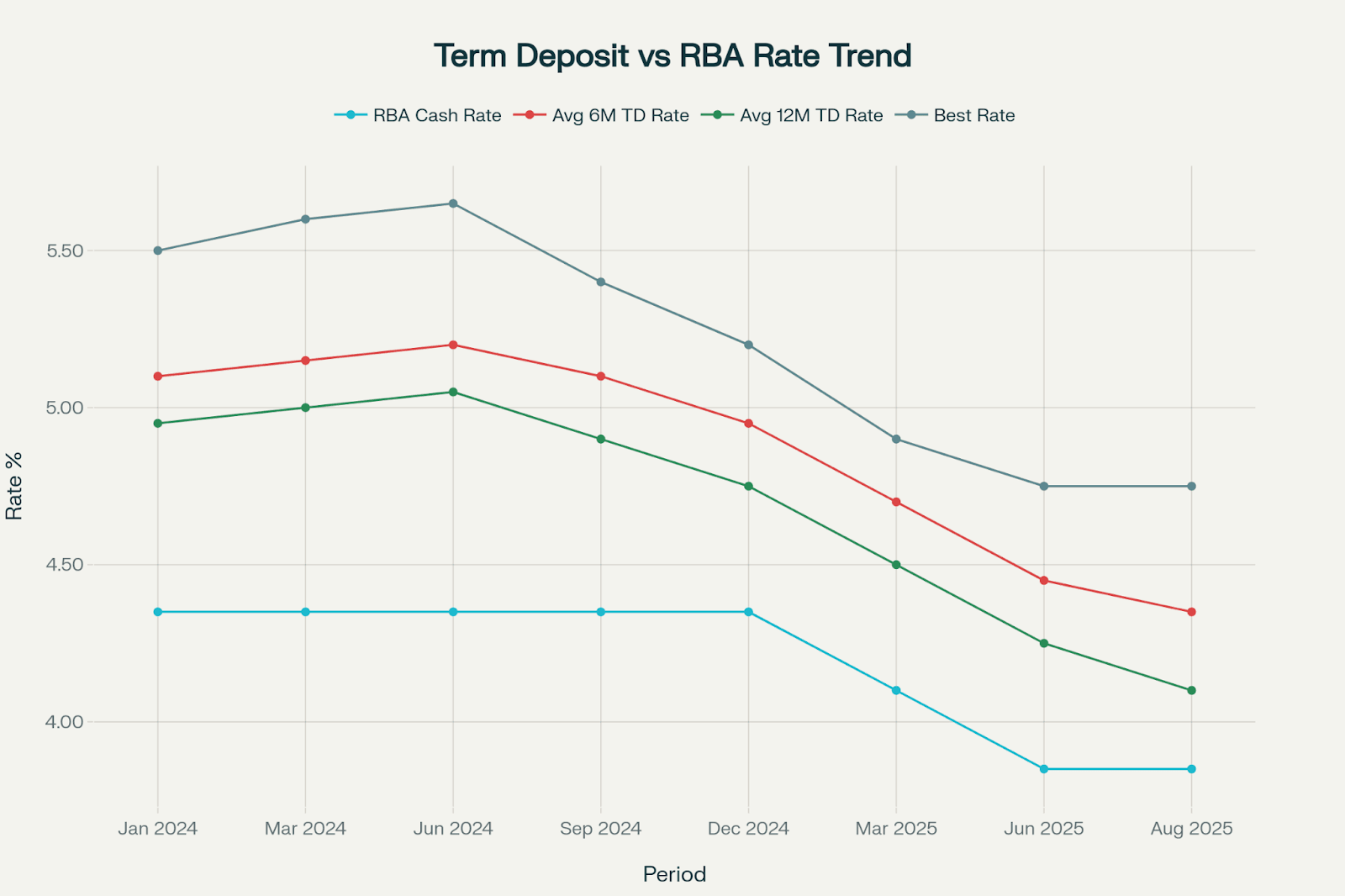

Investors should consider whether they prefer monthly, quarterly, or annual interest payments, and check for any restrictions on early withdrawals, as these can impact flexibility. By shopping around and keeping an eye on Reserve Bank of Australia (RBA) interest rate trends, investors can secure competitive returns while aligning their term deposit with their cash flow needs and risk profile.

For context, here’s a chart comparing the average and best term deposit rates with the RBA’s cash rate since the start of 2024.

Here’s a table of the current top five term deposit rates available in Australia (as at October 2025):

| Institution | Term Length | Interest Rate (p.a.) | Interest Paid | Minimum Deposit | Government Guaranteed? |

| Credit Union SA | 5 Months | 4.40% | At Maturity | $1,000 | ✔️ |

| Judo Bank | 5 Months | 4.35% | At Maturity | $1,000 | ✔️ |

| Heartland Bank | 6 Months | 4.35% | At Maturity | $5,000 | ✔️ |

| Bank of us | 5 Months | 4.20% | At Maturity | $5,000 | ✔️ |

| Bank Australia | 3 Months | 4.15% | At Maturity | $500 | ✔️ |

Please note: Rates are subject to change. Please confirm with the provider before applying.

Understanding Term Deposits: A Secure Investment for Uncertain Times

In today’s volatile economic climate, Australian investors are often looking for stability and certainty. Many are prioritising capital security and predictable returns in the face of market volatility. Yet, standard savings account rates which are tied directly to the RBA’s cash rate can shift rapidly, making it difficult to plan with confidence. The challenge is that while term deposits allow savers to lock in a fixed rate and protect themselves from future cuts, they also mean missing out if rates rise.

As Rachel Wastell of Mozo notes:

‘It’s safe to say that the savers who acted early in the high-rate era of the last few years were the quiet winners. That slower cycle gave savvy savers time to lock in strong returns, and those who did are probably feeling pretty smug right now.’

The question for investors is how to secure the certainty term deposits offer without sacrificing opportunity.

A term deposit is a fixed-term investment offered by Australian banks and other authorised financial institutions whereby you deposit a lump sum of money for an agreed period at a fixed interest rate. Because both the rate and the term are locked in, investors know exactly how much they will earn, making term deposits a safe and predictable way to grow their savings compared with variable-rate accounts.

In practice, term deposits work by requiring investors to commit a set amount of money, often with a minimum deposit requirement, for a chosen fixed term ranging from one month to several years. During this period, term deposit funds are locked away and cannot be accessed without penalties. The interest rate is guaranteed for the entire term, insulating savers from fluctuations in the RBA’s cash rate or market conditions. This combination of a fixed rate, a fixed term, and a fixed lump sum provides the certainty, security, and reliable returns conservative investors are aiming for.

The Financial Claims Scheme (FCS) is an Australian Government initiative designed to protect depositors if a bank, credit union, or building society fails. It guarantees deposits of up to $250,000 per account holder per authorised institution, ensuring that most everyday savers can recover their money quickly and safely in the event of a collapse. The scheme is administered by APRA and activates only if the government declares it.

If triggered, eligible deposits are paid out, usually within seven days, directly to customers, without the need for lengthy liquidation processes. By offering this safety net, the scheme underpins confidence in Australia’s financial system, reassuring term deposit investors that even in rare worst-case scenarios, their savings are secure up to the guaranteed limit.

As Judo Bank explains:

‘Although it has only been activated once for a small general insurer in 2009, its existence helps to maintain confidence in the stability of the Australian financial system.’

What it covers: The FCS guarantees up to $250,000 per account holder, per institution.

While the core concept is simple, term deposits come in five main variations to suit different investor needs:

Term deposits are a powerful tool for savers, but it’s crucial to understand both their benefits and their limitations:

Pros and Cons of Term Deposits

| Pros | Cons |

| Guaranteed Return A fixed interest rate means you know exactly how much you'll earn over the term. This predictability appeals to conservative investors who prefer certainty. | Inflation Risk If inflation rises above your fixed rate, your real return falls. While the nominal interest is guaranteed, the purchasing power of your savings may shrink. |

| Capital Security Your deposit is safe and fully repaid at maturity, provided the bank is covered by the Financial Claims Scheme (up to $250,000 per person, per institution). | Opportunity Cost Locking in your money may mean missing out on potentially higher returns from shares, property, or other investments during the same period. |

| Simplicity Straightforward to set up: you invest a lump sum for a set time at a fixed rate. No ongoing fees, no market tracking, no hidden complexity. | Lack of Liquidity Withdrawing early often means penalties or reduced interest. Term deposits are not well suited for investors who may need quick access to funds. |

| Protection Under FCS The government's Financial Claims Scheme protects eligible deposits up to $250,000 per person, per bank, adding an extra layer of peace of mind. | Limited Flexibility Unlike savings accounts, you can't top up or withdraw funds during the term. You're bound to the conditions agreed at the start. |

Helpful Advice:

‘If you break a term deposit, you may miss out on interest earnings or pay an early withdrawal fee. Giving 31 days’ notice is usually required.’

💡Tip: Because the interest rate is locked in for the entire term, you have complete certainty over your earnings. Term deposits work well as a conservative foundation alongside other income-generating investments like dividend-paying shares, bonds, and income-focused managed funds—helping you build a diversified income portfolio that balances stability with growth potential.

Term deposits provide guaranteed returns and capital security under the Financial Claims Scheme. However, investors seeking higher yields without significantly increasing risk may wish to explore alternative income sources like mortgage funds, which typically offer higher returns in exchange for a longer investment horizon and different risk profile. Both can play complementary roles in a diversified income-focused portfolio.

A common dilemma for savers is choosing between a term deposit and a high-interest savings account. The best choice depends on your financial goals and need for flexibility:

Comparison Table: Term Deposits vs High Interest Savings Accounts

| Feature | Term Deposit | High Interest Savings Account (HISA) |

| Access to Funds | Locked for a fixed term (1 month – 5 years). Early withdrawal usually incurs penalties. | Flexible – you can withdraw anytime, though some accounts may have conditions (e.g., limited withdrawals per month). |

| Interest Rate | Fixed for the entire term, giving certainty. Rates are usually higher than standard savings accounts, but may be lower than the very best HISAs. | Variable – can go up or down depending on market conditions and bank policy. Some offer "bonus" interest if conditions (like monthly deposits) are met. |

| Certainty | Very predictable – you know exactly what you'll earn at maturity. | Less predictable – returns may change if the bank adjusts rates. |

| Best For | Medium-term goals where you won't need access to the money (e.g., saving for a house deposit in 2 years). | Short-term or flexible goals where you may need to dip into savings (e.g., building an emergency fund). |

| Risks | Inflation risk: your fixed rate might look less attractive if market rates rise. | Rate risk: interest could fall, reducing your return. |

Helpful Advice:

‘The key difference between term deposit rates and savings account rates, in terms of the growth of your nest egg in a higher rate environment, is that one is fixed, and one is variable.’

💡Tip: If you have a specific savings goal with a defined timeline (like a house deposit or a new car) and won’t need the cash unexpectedly, a term deposit’s fixed rate can provide valuable certainty. If you need an emergency fund or want the flexibility to access your money, a high-interest savings account is likely more suitable.

To understand the real-world impact of low liquidity, consider this common scenario…

Jack has been carefully saving $20,000 for a house deposit. Wanting certainty and a better return than a standard savings account, he locks his savings into a 1-year term deposit at an interest rate of 5.0% p.a. He expects to earn $1,000 in interest by the end of the year.

Six months later, an unexpected opportunity arises and Jack needs to access his savings early. His bank allows him to withdraw but applies an early withdrawal penalty:

The early withdrawal penalty in the case study is illustrated below:

Table: Impact of Early Withdrawal

| Scenario | Interest Rate | Investment Period | Interest Earned | Total Balance |

| Original Plan (hold full 12 mo.) | 5.00% | 12 months | $1,000 | $21,000 |

| Early Withdrawal (after 6 mo.) | 3.00% | 6 months | $300 | $20,300 |

Note: This example is for illustrative purposes. Penalties vary between institutions.

💡 Tip: Early withdrawal penalties can significantly cut your returns. In this case study, Jack forfeited $700, or 70% of his expected earnings, by accessing his money early. If there’s a chance you’ll need your funds early, consider keeping part of your savings in a more flexible account, and only lock away what you’re confident you won’t need.

Investing in a term deposit is a straightforward process. Follow this checklist to get started.

1. Define Your Savings Goal:

Start by being clear about your purpose. Are you saving for a holiday, building an emergency buffer, or setting aside money for a house deposit?

Your goal determines both how much you can afford to lock away and how long you should choose for the term.

For example, a six-month term might suit short-term savers, while those with longer horizons could consider a two- or three-year option.

💡 Tip: Only invest funds you won’t need to access during the term, as early withdrawals often trigger penalties.

2. Compare Term Deposit Rates:

Don’t just accept the rate offered by your everyday bank. Use online comparison tools to scan the market across the big four banks, regional banks, and credit unions.

But as Moneysmart warns: ‘Comparison websites can be useful, but they are businesses and may make money through promoted links.’

Smaller providers often advertise higher rates to attract new customers, which can translate to hundreds of dollars in additional interest for you.

💡 Tip: Even an interest rate difference of 0.25% p.a. can add up. On a $50,000 term deposit, that’s an extra $125 per year.

Expert Advice:

‘The smartest investors don’t just go with the bank they already use. Shopping around is the single easiest way to boost your term deposit return without taking on more risk.’

Darren Connolly, CEO, InvestmentMarkets

3. Read the Product Disclosure Statement (PDS):

This is the fine print that too many investors overlook. The PDS sets out the term deposit’s terms and conditions, and it’s vital you know what you’re signing up for.

Pay close attention to:

Common Mistake to Avoid: Skimming over the PDS can mean missing a clause that affects your returns. For example, automatic roll-overs might lock your money away for another term without you realising.

4. Gather Your Documents:

Opening a term deposit is usually quick, but you’ll need the right paperwork ready, including:

Having these documents on hand streamlines the application process and avoids delays.

5. Open an Account and Deposit Funds:

Once you’ve chosen your term deposit provider and read the fine print, it’s time to open your account. Most institutions allow you to do this online in under 10 minutes.

After transferring your funds, your chosen term officially begins, and your money is locked in until maturity.

💡 Tip: Double-check the term length and instructions before transferring your money. Accidentally locking away funds you might need can lead to costly penalties.

6. Mark Your Calendar with Your Term Deposit Maturity Date:

Being aware of your term deposit maturity date is worthwhile.

As Bede Cronin, Head of Rabobank Online Savings, explains:

‘It’s always important to be aware of what is happening with your money. Set a reminder for when your term deposit is due to mature or rollover. Also remember that if your term deposit automatically rolls over you have a grace period, usually ranging from seven to 14 days, after the term deposit matures to withdraw your funds or reinvest for a different term without penalty.’

A Common Mistake to Avoid: Forgetting to give instructions for maturity. Many term deposits will automatically ‘roll over’ into a new term if you don’t provide instructions. This new term might be at a much lower, non-competitive interest rate. So set a calendar reminder one month before your term ends to review your options and give new instructions.

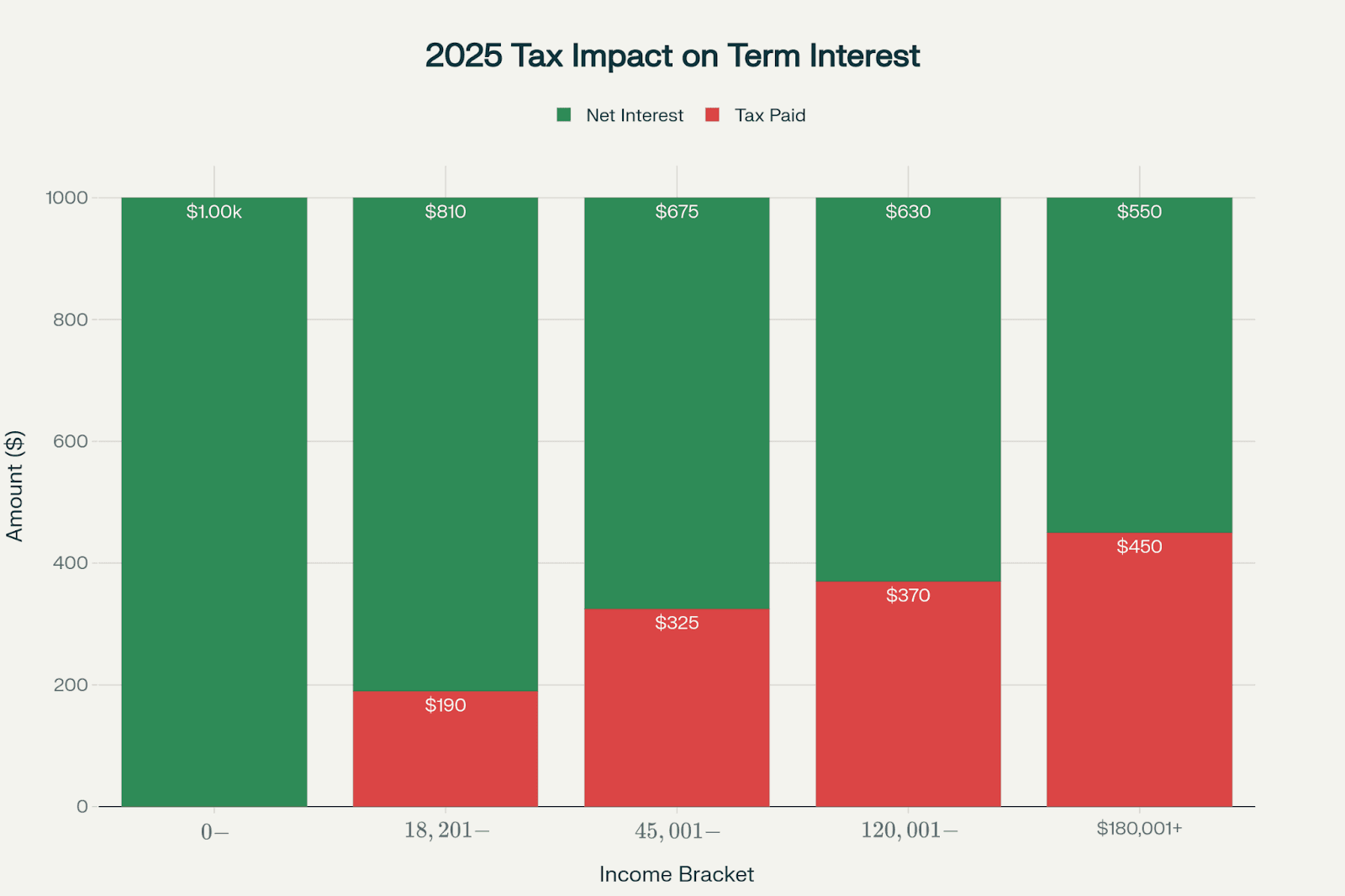

How Interest is Taxed

As shown below, the tax impact of term deposit interest trends upwards in line with your taxable income:

You should give your TFN to the bank or financial institution when you open the term deposit.

‘If your bank doesn’t have your tax file number (TFN), it will withhold tax from your interest at the highest marginal tax rate.’ ATO

Tax Traps: What to Watch Out For

Missing interest because of rollover: Even if you don’t physically get the interest (because it’s automatically rolled into the deposit), you must still declare it in the year it is credited or rolled over.

Joint ownership confusion: If you own a term deposit jointly but don’t split the interest equally (for example, one put more money in), you need clear records to show who is entitled to what. Otherwise the default assumption may work against you.

Not providing your TFN: If you don’t supply your TFN, you could lose more to tax than necessary (because withholding is at highest rate) and then have to sort out refunds later.

Over-lapping financial years: If you have a long-term deposit, and interest ‘builds up’ before maturity, sometimes the timing of when interest is credited versus when it matures can lead to confusion in which year you declare it. You don’t want to accidentally omit it or declare it in the wrong year.

Record-Keeping Tips

Tip: Your bank will send you an annual statement summarising the interest earned. Keep this statement with your other tax documents to make lodging your return easy.

Your money is very safe in a term deposit held with an Australian Authorised Deposit-taking Institution (ADI). Your savings are protected by the Australian Government’s Financial Claims Scheme (FCS). This scheme guarantees deposits up to $250,000 per account holder, per ADI (banks, credit unions, and building societies). This means that in the unlikely event your institution fails, the government guarantees the return of your funds up to that limit. You can verify if your chosen institution is covered by checking the official list on the APRA website.

You can usually access your money before the term ends, but there are important conditions.

Firstly, you are required to provide your financial institution with a 31-day notice period.

Secondly, you will incur an interest reduction penalty. This means the bank will reduce the total interest you have earned as a fee for breaking the term early. The specific penalty varies between banks and is detailed in the Product Disclosure Statement (PDS), but it often results in receiving a significantly lower return than originally agreed.

Finding the best term deposit rates requires a proactive approach.

Follow these steps:

While both are fixed-income investments, term deposits and bonds are fundamentally different on a few factors:

The frequency of interest payments varies by product and institution, and it is a key detail to check in the PDS. The most common options are:

Tip: Interest is typically calculated daily on your principal balance and then paid out according to the schedule you choose.

When your term deposit reaches its end date (matures), you will have a short ‘grace period’ (usually 7-14 days) to decide what to do next. If you do nothing, most banks will often automatically roll it over into a new term deposit of the same length. The risk is that this new term will be at the bank’s standard interest rate, which may be significantly lower than the best rates available on the market.

Your options at maturity are:

The Reserve Bank of Australia’s (RBA) official cash rate is the primary driver of term deposit rates, but the link is not direct.

When the RBA increases the cash rate, it becomes more expensive for banks to borrow money, so they typically offer higher interest rates on savings products like term deposits to attract customer funds.

Conversely, when the RBA cuts the cash rate, term deposit rates usually fall.

However, banks also consider their own funding needs, competition in the market, and their profit margins, so their rates may not move in perfect lockstep with the RBA.

Yes. Term deposits can be a suitable investment for a Self-Managed Super Fund (SMSF). They are often used for the cash allocation portion of an SMSF’s portfolio, providing capital security and predictable returns that can balance out more volatile growth assets like shares and property. The decision to include term deposits should align with the SMSF’s documented investment strategy, which outlines the fund’s objectives, risk tolerance, and diversification plan.

For trustees looking to build a balanced portfolio, the next step is often to diversify your portfolio with managed funds.

The tax rules for a term deposit held in a child’s name (under 18) are different from an adult’s.

According to the ATO, if the interest earned is less than $416 for the financial year, it is generally tax-free.

However, much higher tax rates can apply to income over this amount to discourage adults from diverting their income through children. For interest between $417 and $1,307, the tax rate can be as high as 66%. It’s crucial to understand these rules, which are designed to tax interest at these high rates unless the money was genuinely saved from the child’s own limited sources (e.g. birthday money, part-time job).

Yes, you can absolutely open a joint term deposit with a partner or another person. This is a very common way for couples to save.

Please note that the Financial Claims Scheme (FCS) guarantee is applied per account holder. This means a joint account is protected for up to $500,000 ($250,000 for each person).

And for tax purposes, the ATO generally assumes that each account holder earned an equal share of the interest. You would each declare 50% of the total interest earned on your individual tax returns.