2026 Investment Markets Outlook: A Narrow but Navigable Pathway Upwards

Simon Turner

Mon 5 Jan 2026 16 minutesAs the new year begins, the global economy is on a surprisingly resilient track, although the margin for policy error by governments and central bankers is narrow. With global inflation sticky but moderating and high developed-market government debt, central banks face an ever-finer line in their efforts to cut rates without reigniting inflation or destabilising bond markets.

None of that matters to the world’s bulls right now. Most of them are more focused on the likelihood of global equity markets continuing to hit record highs driven by the AI capex boom and a still-healthy U.S. consumer. If they’re right, the S&P 500 may indeed continue to lead global equity markets, including the ASX, higher.

However, it generally pays to maintain a balanced view of the risks at play. And not all the signals are exuberant right now. Whilst the bulls believe ongoing rate cuts by the Fed will be supportive of global equities, if global inflation runs hot more Fed rate cuts may fail to drive the real economic growth markets are expecting. In that scenario, volatility is likely to return with a vengeance.

2026 is a year that’s likely to be defined by market expectations, the Fed’s actions, and the structural themes that have driven global markets in recent years such as AI, the energy transition, rising defence expenditure, and the re-shoring trend. This outlook argues strongly for diversification across asset classes, regions and styles, and for letting best-in-class ETFs and active funds do the heavy lifting for you.

Below, we discuss what to expect this year from each of the main asset classes and how to gain exposure to the best money-making themes…

1. Macro: Fragmentation, Fiscal Strain & Thematic Tailwinds

The 2026 global macro environment is likely to be defined by four main forces:

- Growing Geopolitical Fragmentation.

Geopolitical risk is expect to remain high and rising this year driven by U.S. tariffs, rising defence spending, the Ukraine War, and ongoing Middle East risk. As a result, friend-shoring and domestically-focused industrial policies are likely to persist, contributing to slowing global trade growth but creating regional winners.

- Elevated but Uneven Inflation.

U.S. and Australian inflation is expected to remain stubbornly sticky as tariffs and re-shoring keep goods prices elevated, while Europe experiences a disinflationary benefit as Chinese exports are diverted there at lower prices.

For Australian investors, the implications are significant. If inflation remains higher than expected, the RBA may not cut rates at all during 2026 (as is already expected), whilst the Fed may cut less than the market expects.

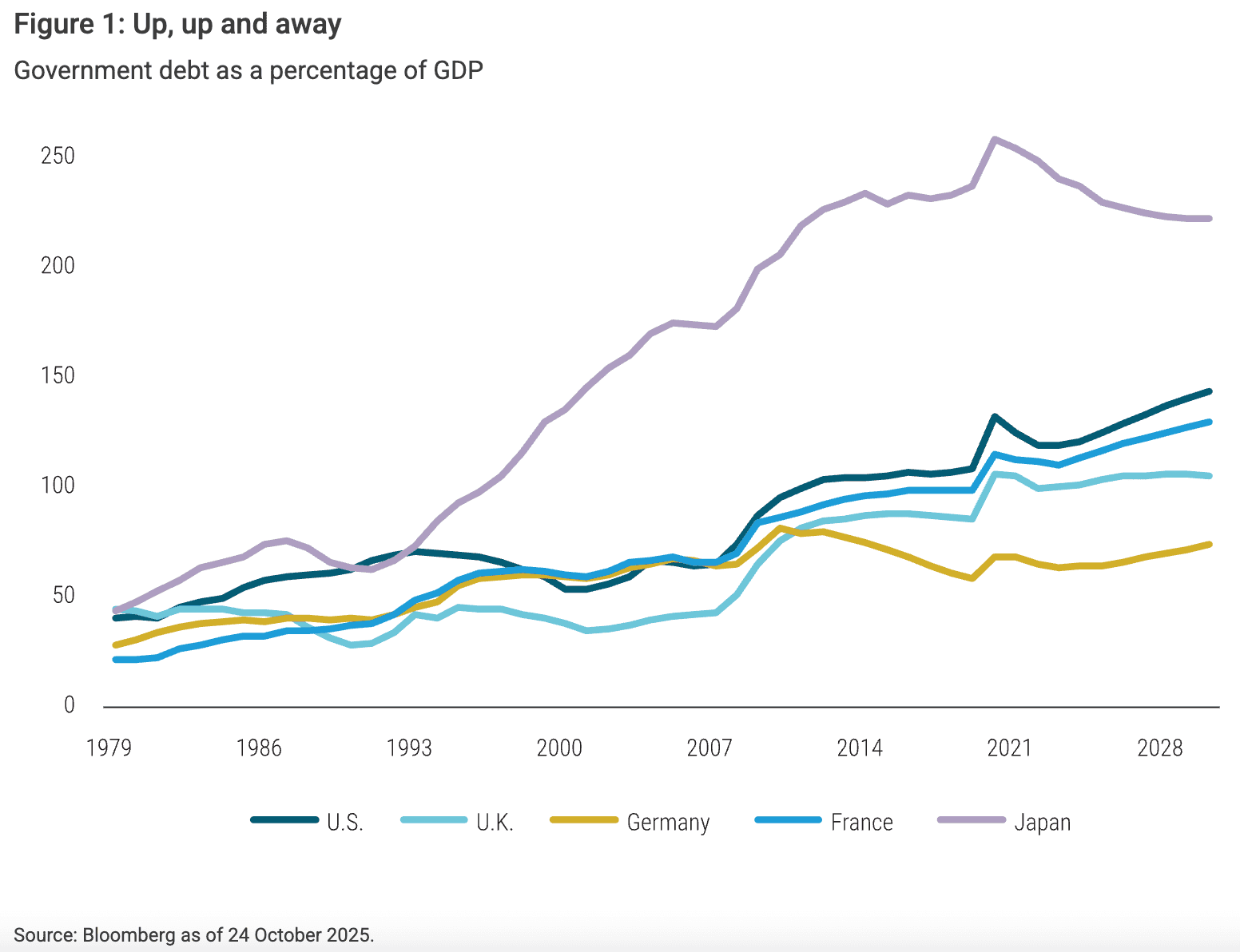

- High Government Debt Creating Bond Market Risks.

Excessive developed market government debt levels are now a major macro risk markets need to contend with.

Major economies such as the U.S. are pushing towards 130%+ debt-to-GDP ratios, which effectively raises the risk of a funding scare that pushes long-term bond yields higher even as central banks cut policy rates.

With this risk ever-present, bond markets are unusually prone to volatility and may not always deliver the defensibility investors expect of them.

- Structural Growth Themes Gathering Pace.

2026 is likely to be a year when the major structural growth themes continue to gather pace.

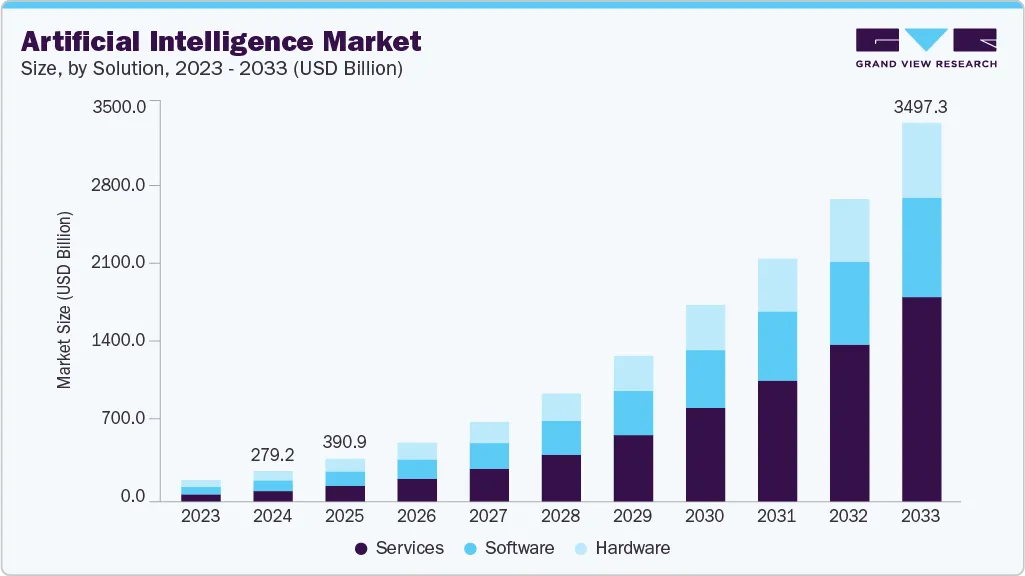

In particular, AI-related opportunities are likely to continue attracting enormous amounts of capital given the significant industry growth expected. Whilst concerns regarding the return on AI capex are likely to persist, the potentially revolutionary upside is still likely to drive the tech sector, and global markets, higher in 2026.

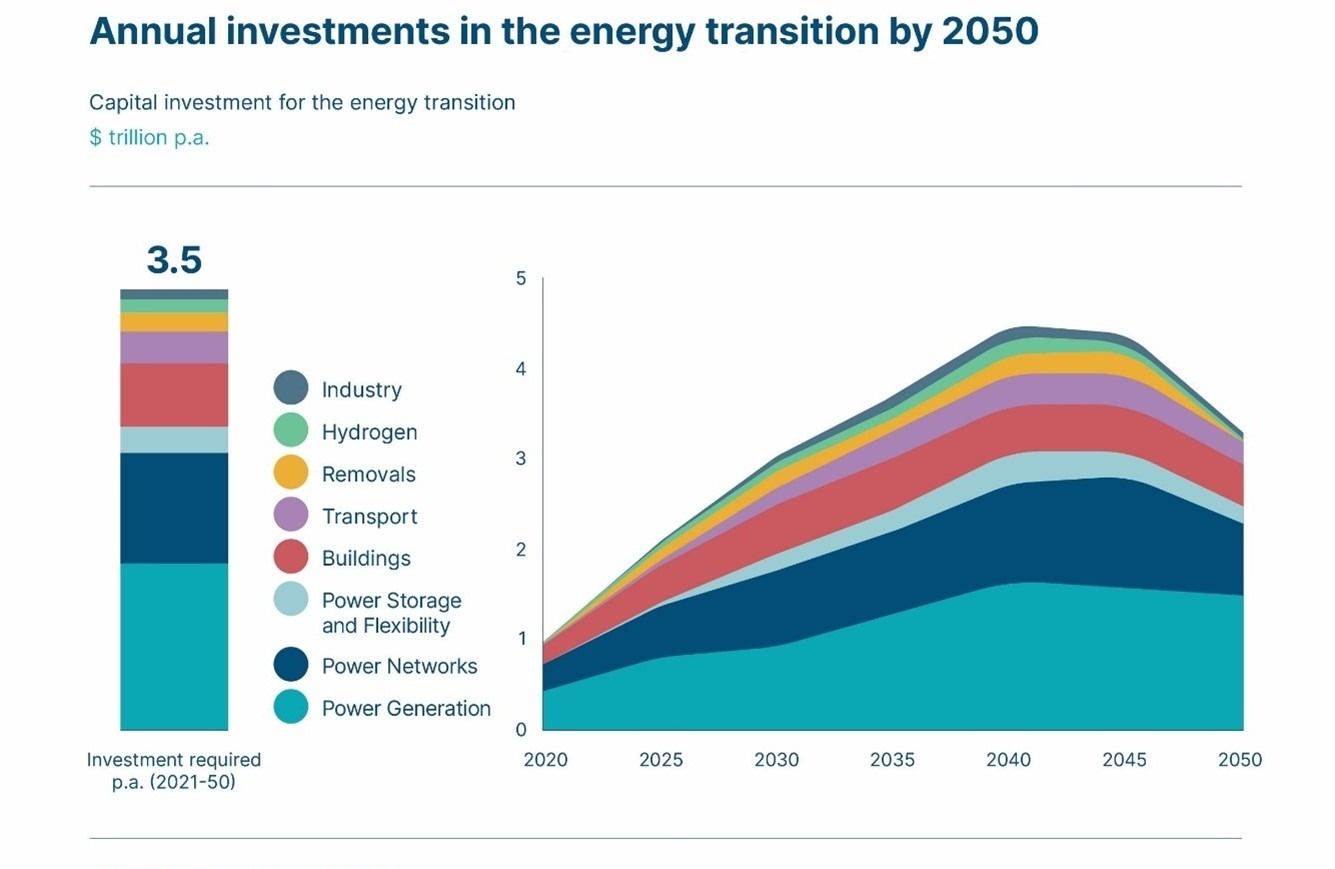

The energy transition is also expected to attract a significant amount of capital in the year ahead with particular focus on power generation, power networks, and sustainable buildings.

Investor Takeaway: 2026 is less about a single macro call and more about building portfolios positioned for moderate economic growth while accepting that policy error, debt stress or inflation flare-ups are non-trivial tail-risks.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Developed Market Global Equities: AI Euphoria, Valuation Strain & Regional Rotation

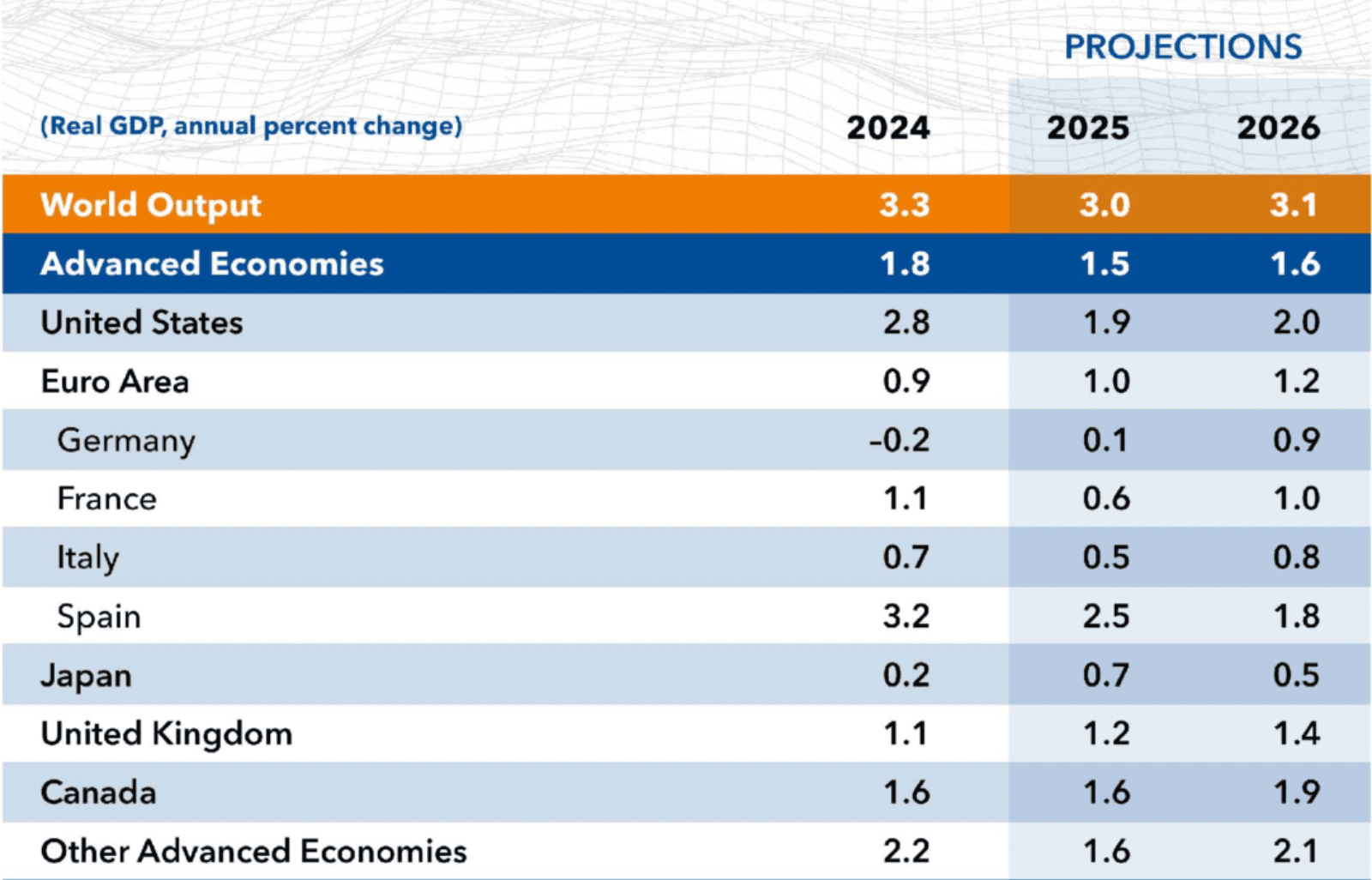

The IMF’s economic forecasts illustrate the challenge for developed market equities in 2026: economic growth in advanced economies is expected to remain relatively anaemic at 1.6%.

So what are the implications for developed market equities?

For starters, developed market economic growth was similarly anaemic in 2025 and that didn’t stop equities from performing strongly. So we’re starting the new year with a similar economic backdrop.

Of course, valuations also matter.

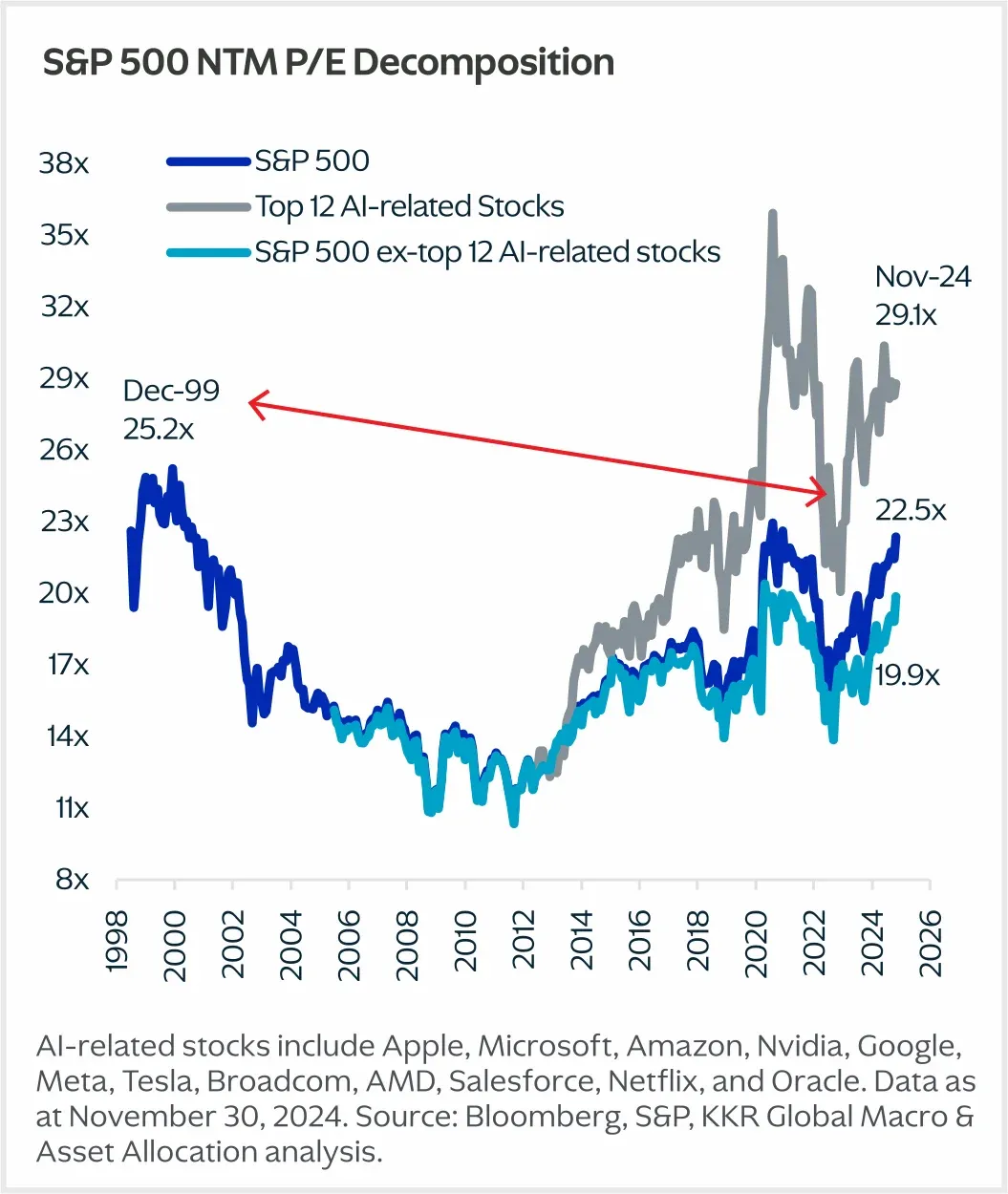

Whilst it’s a popular narrative to claim the S&P 500 in particular is overvalued, a more nuanced view of the all-important U.S. market is more helpful. As shown below, excluding the top 12 AI-related stocks, the S&P 500 is trading well below previous p/e peaks.

So be careful focusing too much on the narrative that the U.S. market is overvalued. It wrong-footed plenty of investors in 2025, and could do the same this year.

Most investment banks concur. UBS’s base case of the S&P 500 reaching 7,500 in 2026 rests on continued earnings growth from AI-exposed mega-caps and ongoing buybacks, while Evercore sees a 25–30% probability that the index overshoots to 9,000 in a late-cycle melt-up driven by the same factors.

At the same time, there’s also plenty to be cautious about after a strong 2025, particularly in the U.S. Nasdaq’s survey of experts highlighted that Fed rate cuts may not be a panacea and that a sharp correction is possible in 2026 if growth disappoints or inflation expectations de-anchor.

Largely as a result of these risks, Columbia Threadneedle expect a broadening of global returns away from US mega-caps toward Europe and emerging markets over the medium term.

This is an important point to be aware of. Europe, in particular, is positioned to benefit from looser fiscal constraints than the US. For example, Germany’s removal of its debt brake to raise funding for defence and infrastructure may be a catalyst for stronger economic growth and earnings potential for European corporates.

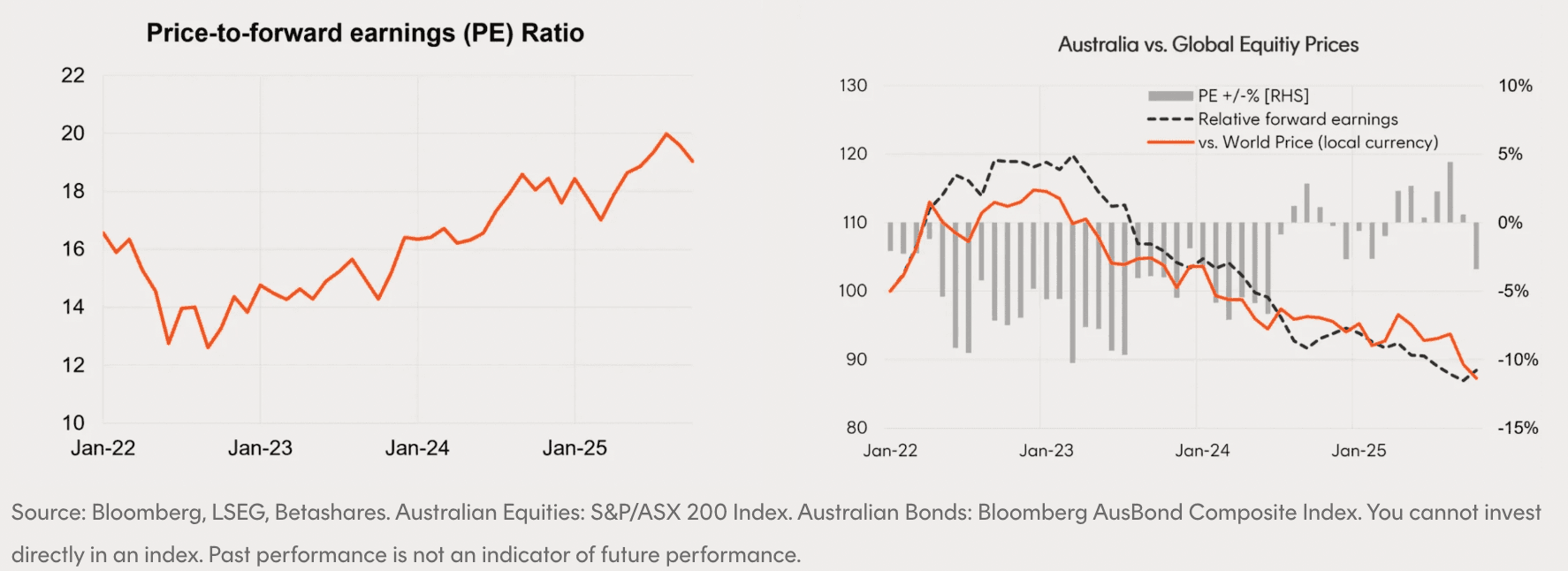

And whilst Australian equities have been a global underperformer in recent years, there are compelling reasons to be more optimistic on the commodities sector in particular in 2026. This bodes well for the ASX this year since it tends to outperform when the resources sector outperforms. As in the U.S., Australian valuations are unlikely to prove restrictive of further upside.

Investor Takeaways:

- Maintain Global Exposure but Diversify by Style & Region.

Rather than doubling down solely on US tech stocks, consider complementing core your global exposures with funds or ETFs tilted towards quality across global portfolios which are genuinely diversified by region.

Given U.S. stocks now dominate most global indices, gaining true regional diversification may depend upon investing in a range of regional funds. Thankfully, this is easy. With the proliferation of funds and ETFs in recent years, investors can now construct the exact portfolio they’re aiming for.

Also, 2026 is likely to reward style diversification, so considering your style exposure may prove prudent. For example, a mix of value, growth, quality, momentum, large-caps, mid-caps, and small/micro-caps is likely to enhance your portfolio’s resilience and thus risk-adjusted returns.

- Maintain High Quality Domestic Exposure with a Tilt Toward Commodities.

Whilst an ASX300 ETF may provide the well-diversified, broad-based exposure you need as the core of your Australian exposure, 2026 is a year when it may pay to be tilted toward the resources sector as the energy transition and AI capex rollout accelerates.

So consider tilting your local portfolio toward best-in-class specialist resources funds and ETFs. After so many challenging years for the resources sector, you’ll want to ensure you’re positioned to benefit from the potential recovery.

- Blend Passive & Active.

2026 appears to be shaping up as a year that’s well-matched to a combined passive-active managed fund strategy: passive funds to gain access to immediate global diversification for a low cost, and active funds to gain specialist/focused exposure to structural investment themes like AI, robotics, cybersecurity, and the energy transition. High quality active funds are likely to continue generating the outperformance needed to justify their fees through superior stock selection.

As always, position sizing and risk limits matter in a market prone to swings.

3. Emerging Market Equities & Debt: Selective Exposure Trumps Blind Beta

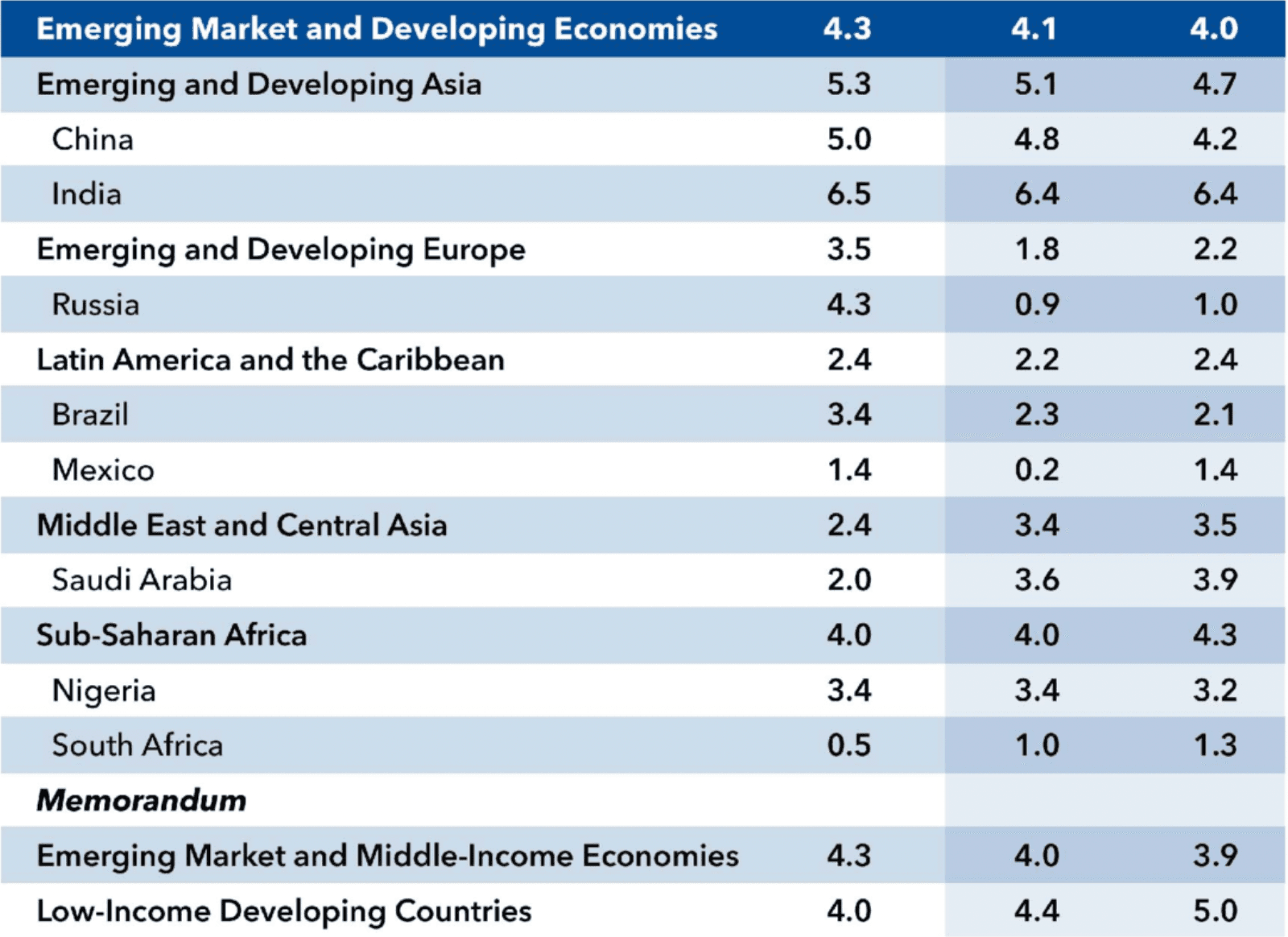

Emerging markets economic growth was 4.1% in 2025 versus 1.5% for advanced economies, while global growth was just 2.3%, the weakest non-recession year since 2008. That emerging markets growth premium is likely to continue through 2026, underpinning the case for selectively increasing emerging markets exposure. Strong domestic demand, expanding digital adoption, and shifting supply chains support this thesis.

Case in point: the IMF projects emerging markets to grow by 3.9% in 2026, outpacing advanced economies, which are expected to expand by just 1.4%. India is likely to be a stand-out performer with ~6.4% expected economic growth in 2026.

There are also key risks to be aware of. China and India face some of the steepest U.S. tariffs, while most emerging markets are navigating the volatilities of supply-chain realignment and the costs of trade fragmentation. Whilst there are likely longer term benefits coming, in the shorter term there could be some trade-related friction that impacts specific emerging markets to varying degrees.

On the fixed income side, the outlook for emerging markets debt is generally buoyant with ongoing support expected from rate cuts, a softer U.S. dollar, and still-reasonable spreads.

Investor Takeaways:

- Emerging Markets Risks Best Addressed via Diversified, Actively Managed Strategies.

Investing in emerging markets equity and debt funds should never be considered a monolithic beta trade. Emerging markets are a highly nuanced world of investment opportunities which arguably require deep understanding and active management.

By investing in diversified actively managed funds with the requisite specialist experience, investors are likely to gain access to stronger risk-adjusted returns in this relatively volatile asset class. So consider active funds which aim to outperform their benchmarks through research-driven stock selection while retaining broad diversification.

- For Targeted Regional Emerging Market Tilts Consider ETFs.

ETFs also have a role to play in providing diversified emerging markets exposure. In particular, they enable investors to regionally or thematically tilt their exposure more to the higher growth regions and sectors.

For example, Asia is expected to contribute over 60% of the world’s GDP growth over the next decade, so arguably deserves a solid allocation within your emerging markets portfolio.

- Global Bond Funds & ETFs Provide Lower Risk Exposure to the Opportunity.

For more conservative investors, a lower risk way to gain exposure to the emerging markets opportunity is via global bond funds and ETFs with emerging markets exposure. Many have 20%+ exposure to emerging markets, and thus benefit from the yield premiums on offer within a risk-managed framework.

- Emerging Markets Allocations Should Be Stress-tested.

Whilst the outlook for emerging markets has rarely appeared more positive, investors should always enter an asset class with their eyes open. That means being aware of the inherent risks, and stress-testing your allocation prior to investment.

For example, it’s worthwhile stress-testing your emerging markets allocation against high-impact scenarios such as: renewed U.S. dollar strength, election risks, and U.S. tariff escalation. This is particularly relevant for Australian investors who are already effectively exposed to Asia through the local economy and their ASX exposure.

4. Fixed Income: Selective Return Driver

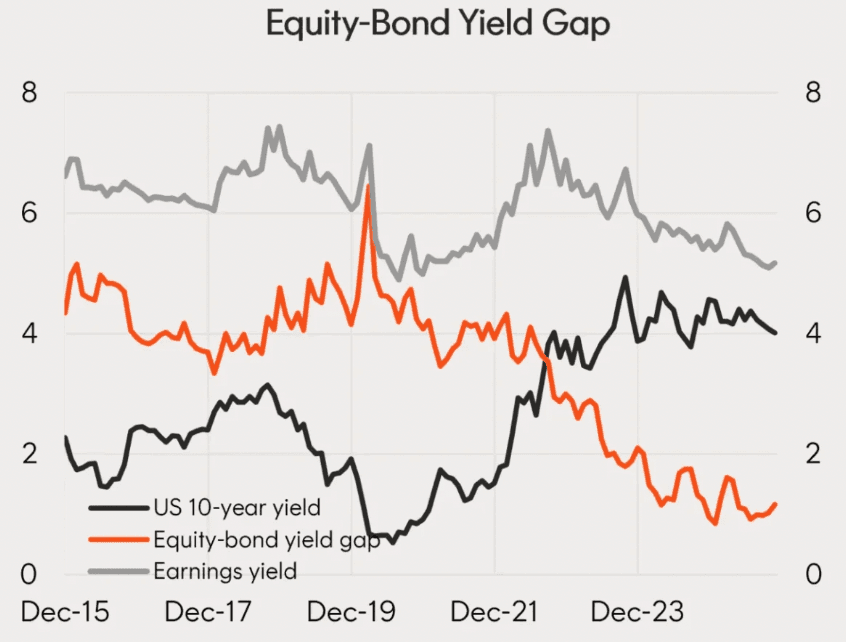

Bonds have quietly re-emerged as a genuine income source over the past couple of years. Whilst most investment banks expect higher returns from equities this year, some segments of the global bond market, such as high yield, offer relatively attractive yields. It’s also noteworthy that the global equity-bond yield gap is usually low which may speak to bond markets offering relative value as the year begins.

However, the fixed income outlook is nuanced in 2026.

For starters, government bonds remain an important portfolio hedge, yet high developed market government debt levels, particularly in Japan and the U.S., and potential related funding scares, could cause bouts of bond market volatility, especially if markets question central banks’ resolve to conquer inflation.

Investment-grade credit spreads are also historically tight, leaving modest compensation for default risk, so security selection and sector tilts matter more than ever.

High yield bonds still offer meaningful yield premiums, but are increasingly sensitive to global economic growth disappointments and funding-market stress. As a result, they should be regarded as higher risk.

Investor Takeaways:

- The Arguments in Favour of Lower Duration Fixed Income Exposure Are Rising.

Understanding duration and curve positioning can materially improve bond portfolio outcomes.

On that note, with global inflation remaining sticky, central banks may be forced to begin another rate raising cycle in the coming years. In the face of that risk, floating-rate and shorter-duration credit is increasingly looking like a prudent way to earn income while reducing sensitivity to rate volatility.

This is also an argument in favour of active management in the bond sector since specialist managers are well-positioned to use duration to their investors’ benefit.

- Global Diversification Can Reduce Regional Yield Curve Risks.

Diversification is just as important in bond portfolios as in equities. Globally diversified bond funds holding a mix of government and corporate bonds can help Australian investors reduce their reliance on domestic banks and the local yield curve.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. Real Assets & Alternatives: Energy Transition, Infrastructure & Property

Commodities are uniquely positioned to benefit from the energy transition, the rising cost of climate-related risk transfer, and the many years of underinvestment in most commodities.

At the same time, the macro outlook depends upon growing investment into renewables, electrification and grid infrastructure, with global energy-transition capex expected to run at roughly double traditional fossil-fuel investment.

This also dovetails with the AI narrative. The hyper-scale cloud and AI leaders plan to increase capex into 2026 to build data centres, and networking and power infrastructure, with clear second-order benefits for utilities, towers, pipelines, and specialist real-asset owners.

With so many growth drivers converging, the 2026 outlook for real assets is unusually positive. Private equity, private credit, mortgage funds, and infrastructure are also well-positioned at this point in the cycle.

Investor Takeaways:

- Commodities Funds & ETFs Positioned to Benefit from Falling Real Rates.

In a world in which inflation remains sticky while commodities demand is rising, commodities funds and ETFs are likely to outperform. Ensuring you have global and local exposure to the resources opportunity is likely to prove fruitful this year.

- Infrastructure Funds & ETFs Provide Defensive Exposure to This Theme.

Infrastructure funds and ETFs are a defensive way to gain exposure to this theme. The sector has historically generated mid-single-digit income and high-single-digit total returns by owning assets linked to regulated utilities, toll roads, airports, and energy infrastructure, all of which stand to benefit from AI-related capex and decarbonisation.

- Diversified Property Funds to Benefit from Falling Real Rates.

Property funds with diversified commercial property exposure are also positioned to benefit from falling real interest rates, while unlisted property trusts and A-REITs blend income with potential capital growth.

- Private Equity, Private Credit & Mortgage Funds also in High Demand.

Alternatives funds, particularly private equity, private credit and mortgage funds, are also positioned to benefit from higher structural demand for unlisted real assets and specialised financing, but require careful due diligence on liquidity, covenants and provisioning.

6. Cash & Defensive Positioning: Optionality Has Value

The opportunity cost of holding cash or cash-plus vehicles is far lower than it was during the zero-rate era. Even if 2026 proves another strong year for risk assets, the asymmetry of outcomes argues for maintaining a meaningful cash buffer.

Investor Takeaways:

-Cash funds, including cash ETFs and hybrid/cash-plus strategies, are effectively parking bays for capital awaiting opportunities as and when bouts of equity volatility return in 2026. That spells opportunity, so a solid cash weighting is an important part of a resilient portfolio.

-Also, cash acts as a liquidity buffer against the potential for gating or redemption delays in less liquid credit and property vehicles.

Practical Principles for Optimal Portfolio Design in 2026

So the outlook for 2026 is cautiously optimistic, albeit with bouts of volatility likely. And of course, no one can rule out a larger correction because none of us know exactly what’s coming. There are plenty of potential catalysts for a bigger selloff in the form of sticky inflation, high developed market government debt/deficits, and high/rising geopolitical risk.

In summary, there are three main principles investors can use to best navigate whatever is coming in 2026:

1. Diversify Across Three Dimensions.

As you’ll have gathered, diversification is about the only free lunch in finance.

Make sure you use it to your full advantage by diversifying across the three main dimensions: asset classes (equities, bonds, real assets, alternatives), regions (U.S., Europe, Asia/EM, Australia), and investment themes (AI, energy transition, defence, reshoring).

Properly diversified portfolios are likely to optimise their risk-adjusted returns this year.

2. Blend Beta with Skill.

Whilst we don’t know exactly what’s going to happen this year, we can prepare for a range of scenarios via a core-satellite strategy which blends beta with skill.

For example, you could invest in a few low-cost broad ETFs for core exposure (e.g. global equity, Australian equity, global bonds), while selectively adding active strategies such as small caps, technology, and emerging markets where you believe research-driven security selection can best help you navigate valuation extremes and other market risks.

3. Value Resilience as Much as Upside.

Portfolio resilience is a function of preparation for the unknown. By maintaining a robust cash weighting, by being deliberate about illiquidity, and by stress-testing your portfolio against higher long-term yields, renewed inflation or emerging market shocks, you can prepare to thrive regardless of market conditions.

None of this replaces personalised advice or due diligence. But by anchoring your portfolio design in these principles, and by using the expanding toolkit of funds and ETFs accessible at InvestmentMarkets, investors can approach 2026 not as a binary bet on boom or bust, but as a year where thoughtful asset allocation and fund selection are likely to matter more than ever.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.