Contrarian Investing in the Age of Real-World AI

Chris Watson & Simon Raubenheimer

Fri 13 Feb 2026 13 minutesWe are in the midst of profound disruption. This is likely to be beyond a typical generational disruption that happens every 20-30 years. This technological singularity is expected to cause dramatic and irreversible changes to human civilization, far beyond typical generational disruptions such as electrification, the internet, or even current generative AI.

The disruption from real-world AI (autonomous driving and robotics) and—ultimately—artificial general intelligence is expected to change most aspects of society. As contrarian, value investors we believe the opportunities created by such disruption are immense. This is indeed a stock pickers market.

In this article, we outline our approach to the current market. We see the total universe of listed shares falling into three broad buckets: AI winners, AI-proof and AI-threatened. In addition, we discuss one of the largest holdings in the Contrarius Global Equity Fund (Australia Registered) (the “Fund”) – EchoStar.

AI Winners

These companies are likely to be the biggest beneficiaries of the technological changes that are upon us. They are however not always obvious and the expected winners may shift over time given the extremely competitive AI environment. Companies perceived as winners today may ultimately be displaced. One needs to be nimble and keep an open mind on changes in relative competitive positions. Being unemotional is essential. Fortunately, we are. Companies currently expected to benefit from AI disruption (or at least the current phase of disruption) include data center-related companies (Oracle, Dell Technologies), semiconductor foundries (TSMC), memory chip makers (Micron Technology, SK hynix), block chain related companies (Coinbase Global) and companies with the ability to straddle multiple areas of AI importance (NVIDIA, Alphabet, Baidu). There are also companies—albeit rare—where the level of confidence is substantially higher than in others. Here you can expect us to hold and maintain a meaningful position in the Fund for an extended period. Tesla would be the best example—but there are others. EchoStar, which we discuss further in this article, is another.

AI-proof

While no companies are truly AI-proof, these are companies whose business models and products are likely to endure—and perhaps even thrive—in the face of AI disruption. Companies that are likely to stand the test of time. They may even be facing short term challenges and currently be out of favour, but the long-term future looks considerably better than those facing disruption. There are several in the Fund today—and the number is likely to grow over time. Shares like lululemon athletica, Kering (Gucci, Saint Laurent, Bottega Veneta), Diageo (Johnnie Walker, Guinness, Smirnoff, Baileys), Pernod Ricard (Jameson, Absolut, Chivas Regal, Malibu, Kahlúa), The Swatch Group (Omega, Longines, Blancpain, Breguet, Swatch), Mondelēz International (Oreo, Cadbury, Milka, Toblerone) and streaming entertainment content owners (Paramount Skydance and Fox).

AI-threatened

It may surprise people, but the third bucket of shares that we spend a significant amount of time on are—hopefully—NOT in our Funds. These are companies whose businesses are soon to be disrupted. Our level of confidence in the extent of disruption may vary. They range from companies that we have a very high level of confidence in total disruption (non-autonomous ride hailing companies, ICE vehicle manufacturers, auto parts companies, certain crude oil-related companies) to those with a reasonably high level of confidence of disruption (middlemen of every kind across all industries, many application software companies) to those where we have a medium level of confidence of disruption (certain traditional payment companies, banks). There are also companies that appear to be AI winners now but where we believe the benefit is illusory or only short-term—these are perhaps the most dangerous investments in the market.

This is not meant to be a comprehensive description of our approach to the current market—but it does illustrate our thought process at this crucial time. As always, valuation discipline remains critical. We remain focused on identifying the shares which offer the most compelling margin of safety and where their competitive advantages (AI-related or otherwise) are in our view, underestimated by the market.

The market has a habit of presenting surprising opportunities. One such opportunity arose only a few months ago. It is now one of the Fund’s largest holdings.

ECHOSTAR AND SPACEX

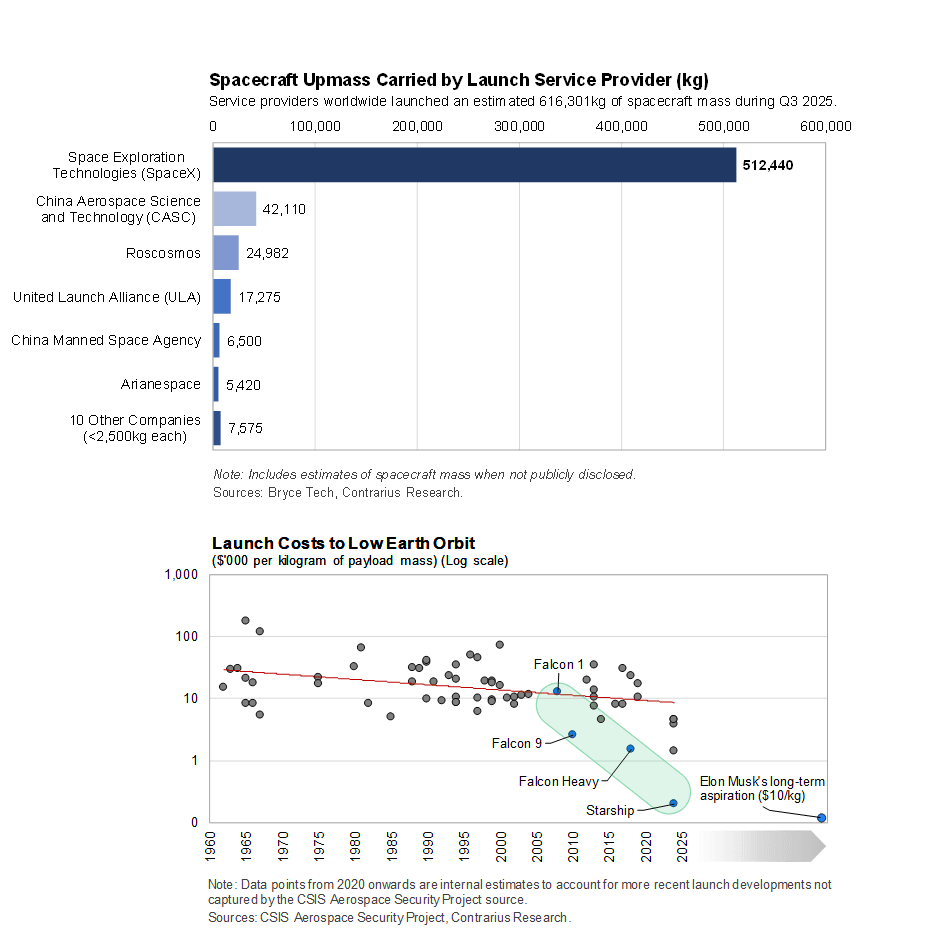

SpaceX has revolutionised space travel with reusable rockets and has the long-term aim of multi-planetary travel via Starship. Its current business lines include delivering payloads to orbit for a wide range of external customers, including government agencies, commercial satellite operators, and research organisations using Falcon 9 and Falcon Heavy rockets. 10 years ago, SpaceX achieved its first rocket retrieval and in 2025 out of the 165 Falcon 9 launches, nearly all were done with reusable boosters.

Looking ahead, SpaceX is uniquely positioned to capitalise on emerging opportunities in space haulage across frontier domains such as interplanetary logistics, in-orbit data centres, asteroid and lunar resource extraction, and other infrastructure-heavy industries that will underpin the next era of the space economy.

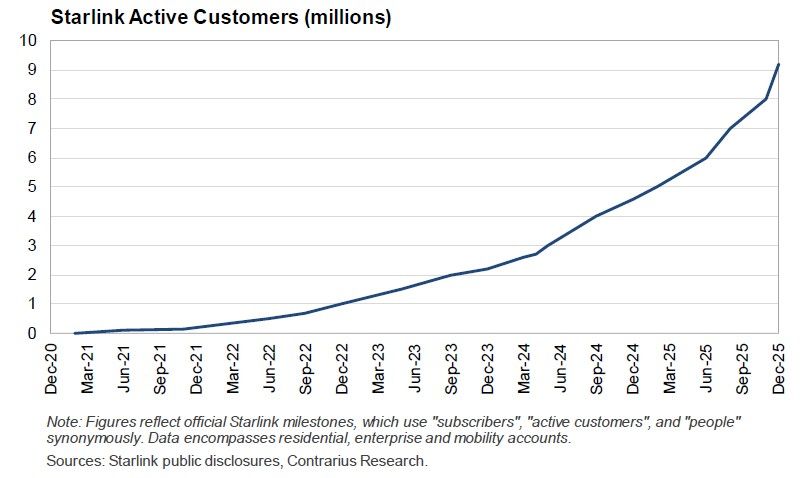

In addition, SpaceX deploys thousands of low Earth orbit (LEO) satellites for its Starlink business, aiming to create a satellite internet constellation with the ambition to deliver affordable but seamless, high-speed, low-latency broadband connectivity globally (including underserved and remote areas).

Beyond fixed broadband (with median download speeds of 220 Mbps), Starlink has recently made a direct-to-cell (DTC) pivot, enabling smartphones to connect via satellite for voice, data, and video.

SpaceX is unlisted, however an interesting turn of events enabled us to gain exposure to SpaceX via a listed company at what we believe to be a remarkably attractive price.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

ECHOSTAR

EchoStar’s history is an interesting one. It started small in 1980 when Charlie Ergen, a former financial analyst, began driving around rural Colorado selling large satellite dishes out of the back of a pickup truck. Seeing the potential for this brand-new industry, he founded EchoStar to make affordable satellite TV accessible to everyday people. EchoStar initially imported and sold satellite dishes, then launched its own satellites. In 1996, it created DISH Network (DISH), a pioneer in Pay-TV. DISH grew into a top US provider with millions of subscribers by capitalising on affordable direct-broadcast satellite technology.

A 2008 corporate split separated DISH (focusing on video services) from EchoStar (emphasising satellite hardware and satellite broadband). But the companies reunited in a 2023 merger to integrate DISH's then 8.8 million video subscribers with EchoStar's wireless ambitions, particularly the building out of a 5G network through the Boost Mobile brand using almost $30bn in spectrum licenses acquired since 2008.

Spectrum is like invisible highways for wireless signals—radio waves that carry data for 5G phones, internet, and satellite links. In the U.S, the Federal Communications Commission (FCC) is the regulator: it auctions spectrum licenses to companies but requires them to "build out" services (e.g. deploy 5G networks) within deadlines, or risk losing the licenses. Spectrum left unused reduces overall network capacity and efficiency.

EchoStar’s 5G network ambition hit multiple speed bumps. High costs, supply chain issues, and competition from giants like Verizon and AT&T slowed rollout. While it had previously negotiated spectrum extensions with the FCC relating to its 5G build out, in May 2025, under a new FCC Chair, a probe was launched regarding EchoStar’s use of spectrum. The FCC threatened revocation of substantial portions of its spectrum licenses accusing the company of failing to meet 5G buildout deadlines and potentially hoarding valuable radio waves (like AWS and MSS bands) instead of deploying them for public use.

Saddled with $27bn of debt, the FCC’s move posed an existential threat to EchoStar, including the possibility of Chapter 11 bankruptcy and freezing the company's strategic options. The company pivoted aggressively and in 5 short months transformed itself into a leaner investor in satellite technology (rather than an investment-heavy wireless builder) and through the process of selling some of its spectrum, has already raised $44bn in proceeds and importantly resolved the FCC probe.

The deals:

EchoStar’s first deal in August involved selling off some of the spectrum licences it owned to AT&T for up to $22.65bn. In addition, it negotiated a Hybrid MNO agreement for its mobile business Boost, eliminating the need for significant future capex and positioning it as an ‘asset light’ business.

Following the AT&T transaction, EchoStar then announced a further sale of approximately half of its then remaining spectrum assets to SpaceX for roughly $19bn. This was structured as $8.5bn in cash, $2bn to cover future interest payments, as well as $8.5bn in SpaceX stock. The transaction was agreed based on a $400bn valuation for SpaceX. In addition, SpaceX and EchoStar will enter into a long-term commercial agreement, which will enable EchoStar's Boost Mobile subscribers to access SpaceX's next generation Starlink Direct to Cell service.

With the proceeds of these agreements, EchoStar is redeeming $11.4bn in secured debt and $1.9bn in convertible debt, interestingly leaving $13.4bn of debt which is mostly encumbered on their Pay-TV and legacy satellite broadband subsidiaries rather than at the parent company level.

In November, EchoStar sold further spectrum to SpaceX for an additional $2.6bn in SpaceX stock at the same $400bn valuation as the first agreement. Once the transactions have completed, EchoStar is expected to hold about 3% of SpaceX. Following SpaceX's recent December 2025 share sale round—which established a new valuation of approximately $800bn, EchoStar’s investment value in SpaceX has effectively doubled. Additionally, SpaceX is actively preparing for a potential initial public offering in 2026, which reports suggest could target a valuation of $1.5 trillion.

Putting it all together:

EchoStar’s remaining operating assets consist of Pay-TV (Dish, Sling), Wireless (Boost Mobile), and Broadband and Satellite Services (BSS, Hughes). While each segment is facing its own challenges, once the transactions have closed and obligations are settled they are expected to be cash flow positive in aggregate, and we estimate that they could generate in excess of $2.5bn in annual operating income.

Capex spend should also decline meaningfully following the shift away from rolling out its own 5G network. In its November earnings call, it was announced that Ergen will return as EchoStar CEO and assume operating responsibility for the Pay-TV and Wireless business units, likely signalling that he sees opportunities for ongoing transformation in this business aided by the partnership with SpaceX.

We believe that these businesses are worth substantially more than the remaining debt.

In addition, EchoStar has remaining attractive spectrum (which they are likely to monetise) which we estimate to be valued at around $13.5bn. They also have potential tax and other liabilities which management estimate to be between $7bn-$10bn. Due to an increase in EchoStar’s share price, the fair value of EchoStar’s convertible debt has also increased by $4.4bn as at 31 December 2025. The notes are convertible into cash, shares of EchoStar’s common stock or a combination thereof, at EchoStar’s election.

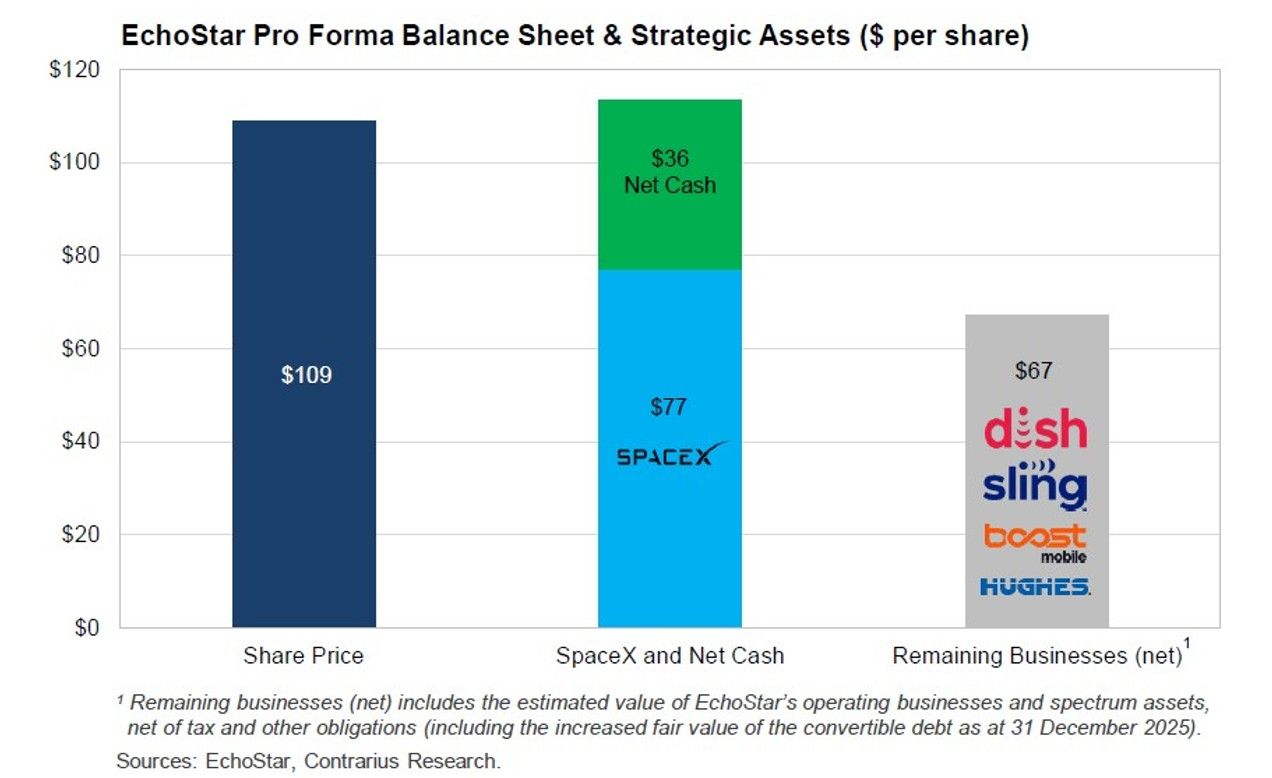

A sum of the parts valuation reveals the following:

At quarter-end, EchoStar's share price stood at $109. Based on SpaceX's most recent $800bn valuation, and assuming the announced deals close, EchoStar's stake in SpaceX would be worth approximately $77 per share, with net cash adding $36 per share—for a combined value of $113 per share.

Our investment in EchoStar thus provides us with exposure to SpaceX at a discount to the SpaceX and net cash component of EchoStar, while effectively obtaining the remainder of EchoStar's spectrum assets and operating businesses (net of liabilities) for free. Furthermore, with the progress that SpaceX continues to make with strong growth in Starlink subscribers, record launches and Starship progress—we believe that the long-term upside for EchoStar's holding in SpaceX is significant.

Management have made excellent capital allocation decisions over the last several months that have dramatically increased the value of EchoStar. In addition to the valuable stake in SpaceX, we believe that management are likely to leverage EchoStar’s strong capital position and industry knowledge to add further value over time. While the various deals have not yet closed, we believe that the risk of them not closing is relatively low given that they resolve the FCC’s concerns.

While EchoStar has already contributed meaningfully to the Fund’s performance, we continue to believe that it is exceptionally attractive and it is one of the Fund’s largest holdings.

Conclusion

As contrarian investors we are finding value in a variety of very different stocks. As you would expect from our introductory comments, these include companies that we believe to be AI winners and more traditional value-oriented shares which we consider to be AI-proof. The Fund’s composition remains extremely different to the current composition of the MSCI World Index. We believe that valuation disparity within the market is significant and creates meaningful opportunities for stock pickers like ourselves.

Disclaimer: This article is based on a commentary prepared by Contrarius Investment Advisory Pty Limited (“Contrarius Australia”, AFSL 506315), distributor of the Contrarius Global Equity Fund (Australia Registered) (ARSN 625 826 075). The investment manager of the Fund is Contrarius Investment Management Limited. Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Fund. Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Information is valid as at 31 December 2025. This information is general in nature and has been prepared without taking into account your personal objectives, financial situation, or needs. Before acting on this information, you should consider its appropriateness and should read the relevant Financial Services Guide (FSG), Product Disclosure Statement (PDS) and Target Market Determination (TMD) available at www.contrarius.com.au. The article is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, neither Contrarius Australia, Equity Trustees, nor any of their related parties, directors or employees, nor InvestmentMarkets (Aust) Pty. Ltd. as publisher, provide any warranty of accuracy or reliability in relation to such information, or accept any liability to any person who relies on it. Interested parties should seek independent professional advice prior to acting on any information presented. Past performance is not a reliable indicator of future performance. Funds managed or distributed by Contrarius Australia may have a position in any of the securities referred to in this article, and such positions are subject to change at any time without notice.

Chris Watson

Director at Contrarius Investment Advisory Pty Limited.

Chris joined Contrarius Australia in January 2021. Chris was previously a director of Contrarius Investment Advisory Limited ("CIAL") in the United Kingdom from June 2017 until June 2018. He was employed by CIAL as an investment analyst from April 2012 until June 2018. Chris also previously worked for Allan Gray Ltd, South Africa’s largest privately-owned investment firm. He holds a Bachelor of Business Science (Quantitative Finance) from the University of Cape Town, and is a CFA and a CMT charterholder.

Simon Raubenheimer

Director at Contrarius Investment Management Limited.

Simon joined the Investment Manager in March 2019. He is a director of the Investment Manager and Contrarius ICAV, an Irish UCITS fund to which Contrarius Investment Management Limited is the Investment Manager. Simon has over 16 years’ previous investment experience with Allan Gray Ltd, South Africa’s largest privately-owned investment firm. Simon completed a BCom (Econometrics) Degree at the University of Pretoria and a BCom (Honours) (Financial Analysis and Portfolio Management) Degree at the University of Cape Town. Simon is a CFA charterholder.