Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| -2.43% | -13.1% | -19.47% | 3.45% | 2.27% | 3.16% | 17 Feb 2020 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.9% | 0.08% | 0.98% |

The ECP Growth Companies Fund, managed by ECP Asset Management and distributed by Copia Investment Partners, is designed for investors seeking long-term capital growth through a concentrated portfolio of exceptional Australian and New Zealand companies. Established in 2012 by Dr Manny Pohl and Jared Pohl, ECP Asset Management is a boutique, staff-owned investment firm, ensuring complete alignment of interests between its investment team and clients.

The Fund invests in 10 to 30 high-quality growth businesses that demonstrate the ability to generate predictable, above-average economic returns over time. These are companies in the growth phase of their life cycle — resilient, innovative, and competitively positioned to deliver strong compounding returns.

ECP’s philosophy centres on the belief that the economics of a business drive long-term investment returns. The investment team focuses exclusively on what it calls “Quality Franchises” — businesses with durable competitive advantages, strong management, and the capacity to sustain superior returns on equity while maintaining low levels of debt.

Through comprehensive bottom-up research, ECP seeks to identify companies that combine growth, quality, and sustainability. The team’s proprietary “Pillars of a Quality Franchise” framework integrates environmental, social, and governance (ESG) factors into every stage of the investment process. ESG considerations are not treated as a separate overlay but as a core element of assessing business resilience and long-term predictability.

A disciplined approach to valuation ensures that even outstanding companies are only acquired when their share prices represent a margin of safety. This combination of fundamental analysis, valuation discipline, and active ownership forms the foundation of ECP’s approach and differentiates it within the Australian equity landscape.

Investing in the ECP Growth Companies Fund offers:

-

Access to a focused portfolio of exceptional growth businesses selected through a proven research process.

-

Alignment of interests, with the investment team co-invested alongside clients.

-

A long-term growth focus, targeting to outperform the S&P/ASX 300 Accumulation Index by 2–4% per annum (before fees) over rolling five-year periods.

-

Integration of ESG and sustainability as part of investment decision-making, enhancing the resilience and quality of portfolio companies.

-

Professional portfolio management backed by more than 85 years of combined investment experience within the team.

With a five-year-plus investment horizon, the Fund is best suited to investors seeking strong capital growth potential through a concentrated, high-conviction approach to quality Australian equities.

Prior to joining ECP Andrew worked for over 13 years in equities sell-side research with both Macquarie Bank (9 years) and ABN Amro (4 years). He is experienced across regions including Australia, New Zealand, Pan Asia and most recently having lead the expansion and coordination of the Global Material and Energy products at Macquarie. Andrew is interested in all things Asian – particularly the food!

Prior to co-founding ECP, Jared was part of the Hyperion Investment team until 2012. In addition, Jared spent some time seconded to Wasatch Advisors in Salt Lake City. Prior to his time in financial services, Jared consulted on a number of IT projects. He has continued to be involved in the entrepreneurship space, regularly giving lectures to Students on Tech Investment and Entrepreneurship. Jared balances out all this left-brain activity, with Yoga, Meditation and Mindfulness.

Sam joined ECP in 2016. Prior to joining ECP, Sam spent 8 years at Bell Potter Securities on the sales desk and as a Small Caps Research Analyst. Sam covered a range of small and mid cap industrials and cyclicals. When Sam’s not crunching numbers you can find him surfing or fishing in Sydney Harbour.

Damon joined ECP in 2017 having previously held positions at Fidelity International from 2013 to 2017, covering various sectors including Property, Mining, Energy and Utilities. Prior to this he worked in equity research at various investment banks including Nomura and J.P. Morgan, covering Small Caps, Telecommunications & Media. Damon also has some secret carpentry skills that he puts to work in his down-time!

Jason joined ECP in 2012 and is responsible for identifying investment opportunities, company specific research and the firm's responsible investment efforts. Prior to joining ECP, he completed a clerkship at Ashurst, focusing on Corporate Law. He is admitted as a legal practitioner in the Supreme Court of NSW. Picking investments is like picking wine and in another life Jason would be a sommelier!

Prior to joining ECP in 2021, Justin spent seven years at First Sentier Investors across a number of investment roles, including as a member of the Emerging Companies team in Sydney and the Global Infrastructure team in London. When he's not in the office, you can usually find Justin at the movies or on the rugby field.

Annabelle joined ECP in 2022 from PM Capital where she spent eight years in the global investment team covering Consumer Staples, Consumer Discretionary, Information Technology, Health Care and Communication Services. Prior to PM Capital, Annabelle spent two years at Perpetual Investments in various roles. Annabelle has a keen sense of humour and spends most weekends chasing after her high-spirited toddler.

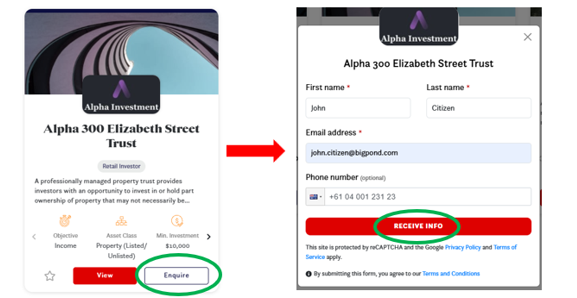

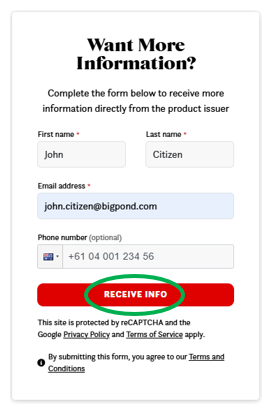

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Published by Copia Investment Partners Ltd

FIXED INTERESTINVESTOR EDUCATION

SHARESINVESTOR EDUCATION

INVESTMENT THEMESSHARES

Published by Copia Investment Partners Ltd

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.