ETF Flows Tell The Story: Where Australian Money is Moving in 2025

Sara Allen

Fri 24 Oct 2025 9 minutesIn a year where headlines have been dominated by tariffs, geopolitical activity and the ongoing AI boom – and there are queues for gold bullion snaking down Martin Place – it’s unsurprising that investors are following the money and using ETFs for swift access.

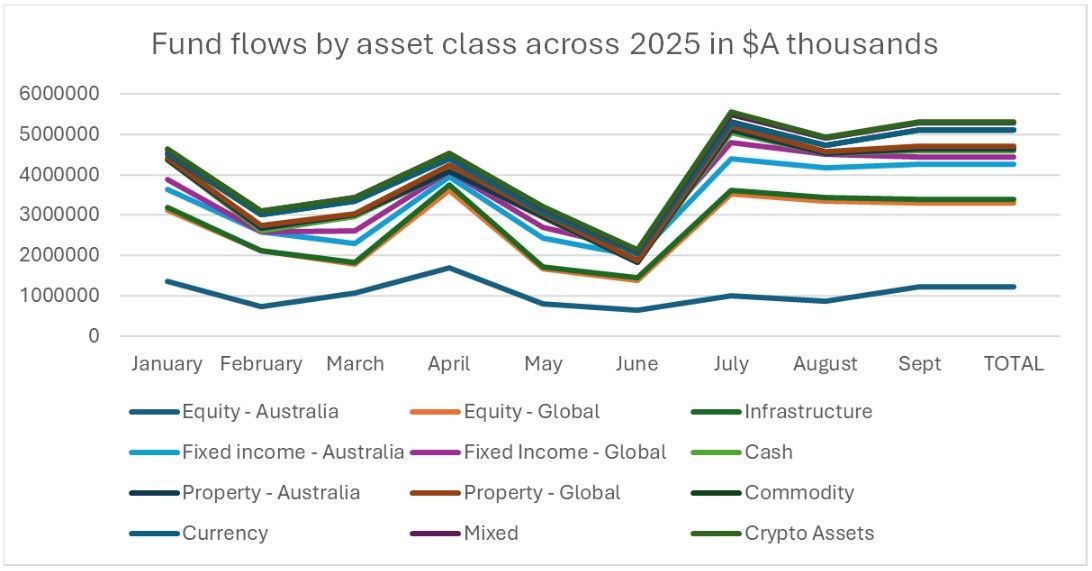

Equity products have dominated investor flows, with passive indices attracting the lion’s share of interest, according to Rory Cunningham, Senior Manager – Investment Products for the ASX.

“There’s also little evidence of large outflows from major categories – flows have been broadly positive across sectors,” he said.

He added that the market’s largest players usually capture the bulk of the flows.

“The large issuers, like Vanguard, Betashares, iShares, VanEck and GlobalX capture a high share of inflows. We see similar trends overseas. This shows that brand, scale and inertia are strong advantages in the ETF industry.”

The ASX-listed ETF market jumped to a record $300.03bn in funds under management at the end of September. That’s more than quadruple its size only five years ago. There’s also more than $10bn via Cboe.

So where have the 2 million Australians who use ETFs moved their money in 2025 so far?

International equities dominate flows

Traditionally, international equities have dominated flows as Australian investors seek to use ETFs for exposure, often preferring direct listed equities for domestic exposure. Most international flows headed towards US-aligned ETFs.

While there was some dip in activity in March as investors waited on the results of Trump’s tariffs and in June leading into the end of the financial year, flows have been positive and strong on this front. This is in keeping with a record year for markets. As of 21 October 2025, the S&P 500 is up over 14% for the year, while the NASDAQ 100 is up 19.86%.

Most Popular International Equity ETFs by Flows

- Vanguard MSCI Index International Shares ETF (ASX: VGS) – $1,882m of inflows.

- Vanguard MSCI Index International Shares (Hedged) ETF (ASX: VGAD) –$1,136m of inflows.

- Betashares Global Shares ETF (ASX: BGBL) – $1,057.45m of inflows.

Source: ASX Investment Reports January-September 2025. Calculated by adding Funds Inflow/Outflow $m.

Noting that flows tend to be dominated by institutional activity, particularly superannuation funds, it can also be insightful to look at trends within retail investors and sophisticated investors like self-managed superannuation funds (SMSFs).

Australian investing platform Stake found that the iShares S&P 500 ETF (ASX: IVV) has been the most traded ASX ETF for the last 12 months – and this held true regardless of age grouping. VGS was popular with this audience too, and the Betashares NASDAQ 100 ETF (ASX: NDQ) also ranked in the top five. Global X Fang+ ETF (ASX: FANG) was a popular choice, given the continued dominance of the Magnificent Seven.

When it came to the SMSF audience, there was also a focus on quality, with the VanEck MSCI World ex-Australia Quality ETF (ASX: QUAL) featuring as a holding in 12.8% of funds according to Morningstar data.

Russel Chesler, Head of Investments and Capital Markets for VanEck Australia, notes that this interest in quality has risen in recent months with markets “priced to perfection” and volatility hitting at different points.

“We have seen a higher proportion of investors undertake a “flight to quality” in recent months. We think there will be a greater appetite for investing in quality companies, as these stocks have historically fallen less in a downturn and recovered faster,” Chesler said.

Like investors, ETF issuers have focused their efforts on international offerings.

“Almost 50% of new issuance was global and across a broad range of strategies, such as index tracking, active, sector bases (defence and infrastructure), along with style/factor issues (like growth),” said Cunningham.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Australian Exposure Remains Important

Though second to international equities, flows have still piled into Australian equity ETFs. The Australian market has held strong across the year, bolstered by easing rates, more stability in inflation, and good employment numbers.

Most Popular Australian Equity ETFs by Flows

- Vanguard Australian Shares Index ETF (ASX: VAS) – $2,536m of inflows.

- Betashares Australia 200 ETF (ASX: A200) – $1,541.96m of inflows.

- Vanguard Australian Shares High Yield ETF (ASX: VHY) – $1116m of inflows.

Source: ASX Investment Reports January-September 2025. Calculated by adding Funds Inflow/Outflow $m.

VAS is the largest and typically most popular ETF in Australia with $22,489.9m assets under management as at 30 September 2025. This is also reflected in Stake’s data which found VAS was the second most bought ETF across all age groups of investors on its platform. Both A200 and VHY ranked in the top 10 most purchased also in this retail segment.

It is the most popular holding for SMSFs, and held by 13.5% of funds.

In this bracket, the ASX’s Cunningham noted evidence of active ETFs starting to gain traction. For example, Macquarie’s Core Australian Equity ETF (ASX: MQAE) has generated $433.49m of inflows year to date.

There has also been growing interest in smart beta style strategies to better capture market upside – this has been true of both global and domestic equity ETFs.

“In the 2025 year to date, inflows to smart beta strategies have consistently topped $500 million (or come very close to it), and two months exceeded $1 billion,” says VanEck’s Chesler.

The VanEck Australian Equal Weight ETF (ASX: MVW) has been a popular example this year with $399.89m of inflows.

Activity in Bond Markets

Off the back of an easing cycle and the phasing out of hybrid securities, fixed interest ETFs have been attractive to investors with meaningful inflows.

Most Popular Fixed Income ETFs by Flows

- Vanguard Global Aggregate Bond Index (Hedged) ETF (ASX: VBND) – $1,499m of inflows.

- VanEck Subordinated Debt ETF (ASX: SUBD) – $872.62m of inflows.

- Vanguard Australian Fixed Interest Index ETF (ASX: VAF) – $683.64m of inflows.

Source: ASX Investment Reports January-September 2025. Calculated by adding Funds Inflow/Outflow $m.

The ASX’s Cunningham highlights that even cash ETFs have benefited from the strong interest in fixed income, with the iShares Core Cash ETF (ASX: BILL) a popular example.

“This interest has also extended into other product structures on the ASX. We’ve seen record capital raising in the LIT and retail debt structures for underlying bond and private debt strategies,” he said.

Retail investors in Stake favoured cash in the form of the Betashares Global High Interest Cash ETF (ASX: AAA) while, according to Morningstar’s data, SMSF investors typically used Betashares Australian Hybrids Active ETF (ASX: HBRD), Betashares Australian High Interest Cash ETF (AAA), iShares Core Composite Bond ETF (ASX: IAF) and Betashares Australian Bank Senior Floating Rate Bond ETF (ASX: QPON).

According to VanEck’s Chesler, the easing cycle has “prompted investors to look beyond traditional bond markets to find enhanced yield opportunities.” He has found particular interest in the VanEck client base for subordinated debt.

“Subordinated debt has been an exceptionally strong contender due to its favourable position in a bank’s capital structure – below ‘senior debt’ or traditional bonds, resulting in a yield uplift and above ordinary shares and hybrids, which means lower risk,” he explained.

The VanEck Subordinated Debt ETF (ASX: SUBD) has benefited from this interest, ranking as one of the top net flow performers across 2025.

Going forward, Chesler anticipates increasing interest into subordinated debt, mortgage-backed securities and private credit as hybrid securities are phased out. He also sees bonds at the long end of the curve as attractive.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Other Themes to Watch

In a year where gold prices have passed US$4,000 and geopolitical uncertainty has helped fuel interest, it’s unsurprising that flows also headed into gold etfs – both physical bullion and miners.

Global X Physical Gold (ASX: GOLD) was the most popular gold-backed ETF, with $492.66m of inflows across the year, while Perth Mint Gold (ASX: PMGOLD) was a close contender at $435.99m of inflows.

In keeping with this trend, Stake noted a 73% uptick in trading volume to GOLD over the last month and saw interest rise in other physically-backed gold investments, like PMGOLD.

Chesler expects the interest in gold to continue into 2026.

“Gold should also continue to benefit as a classic ‘safe haven asset’. Although the gold price is at an all-time high, we think it has further room to run, with investors benefiting from the diversification it can add to portfolios during times of uncertainty,” he said.

Interest in cryptocurrencies has also been fuelled by the passing of the GENIUS Act in the US, and a range of legislation around stablecoins globally. Bitcoin prices have gained over 10% for the year to date, and over 65% for the last 12 months.

The listed ETFs in this space are newer, with the first funds listed on the ASX in 2024. There are others also listed on Cboe.

“Bitcoin strategies are closing in on $500m of CHESS FUM,” says Cunningham.

The VanEck Bitcoin ETF (ASX: VBTC) has been the most popular on the ASX, and has generated $143.44m in cashflows across the year to date.

Interestingly, there is some difference in use between older and younger investors in this space.

Based on Stake’s data, cryptocurrencies only featured in the most traded investments for investors aged over 45 years. Along with the VBTC, they also used Global X Bitcoin ETF (ASX: EBTC) and the Betashares Crypto Innovators ETF (ASX: CRYP) for a more indirect exposure.

Chesler believes the interest in cryptocurrencies will continue, especially off the back of draft legislation to establish a regulatory framework for digital assets and tokenised custody platforms in Australia.

Other emerging sectors to watch include global defence and nuclear energy.

“We expect to see more governments take a leaf out of the Trump administration’s playbook and focus on domestic self-sufficiency for national security as well as energy production,” Chesler said, adding that nuclear has been identified as one of the most viable, low-emission options for energy-intensive applications like AI.

Bumper Year

It has been a record year of flows into ETFs, and this growth is expected to continue.

“We predict the industry will grow at a 20% compound annual growth rate for the next five years, surpassing $750 billion by 2030,” says Chesler.

There’s plenty to watch in the market – and greater range and depth in offerings than ever before.

Disclaimer: This article is prepared by Sara Allen for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.