Think You Can Time the Market? Think Again

Simon Turner

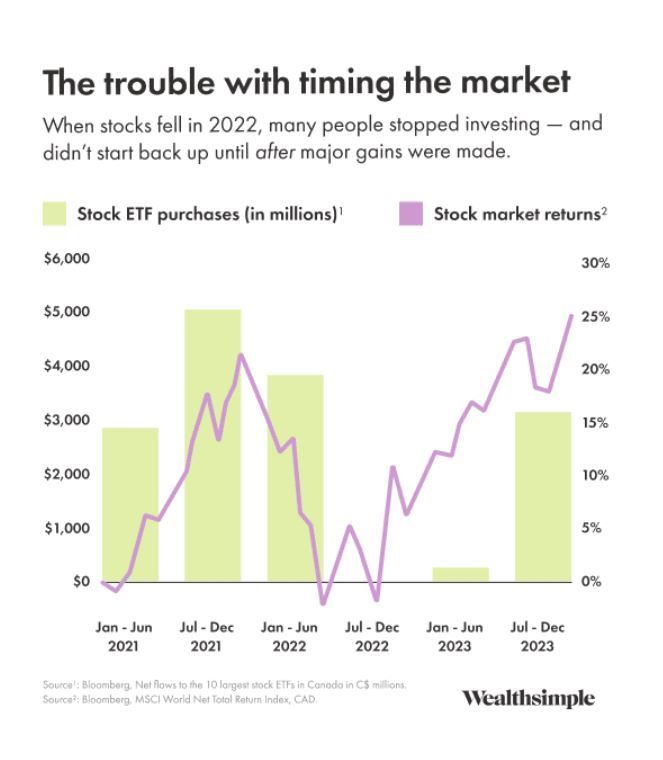

Wed 7 May 2025 5 minutesResearch has long recognised the inconvenient truth that investment losses sting with around double the intensity of the joy an investment profit can bring. Hence, a gain of $10,000 makes you smile, but a loss of the same amount feels like a punch to the gut.

This is why so many financial advisers echo the same vital piece of advice: resist the urge to time the market…

Case in Point: The April 2025 Selloff

A dramatic illustration of this situation took place only a few weeks ago when the Australian share market experienced its most significant one-day drop since 1992.

The market plummeted 4.2% plummeted on April 7th, only to rebound a few days later with a 4.6% surge. In fact, April 10th marked one of the ASX’s top ten best days since 2000, riding on the coattails of a 9.5% rally from the S&P 500 just a day earlier.

Of course, when volatility returns without warning like this, most investors intend to stay calm. Many even intend to buy more of their favourite funds and stocks into weakness.

But then the market selloff arrives and the collective fear is overwhelming.

For many investors, their best intentions go out the window as their fears take control of their investment decision-making. So not only do they not stay calm or buy more into weakness, they often sell their investments at exactly the wrong moment in favour of awaiting clearer skies before jumping back in.

This story explains why volatility tends to beget more volatility: investors’ fear-driven selling scares other investors to sell which accentuates the volatility.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Here’s the Rub about Selling into Weakness

But here’s the rub: timing the market is an elusive art. In the words of Nick Murray: ‘Timing the market is a fool’s game, whereas time in the market is your greatest natural advantage.’

This isn’t just true over the long term, it’s also a short term reality. Research shows that the worst market days often precede the best ones, so reactive investors are often scared into selling just before the market recovers.

This trap is so easy to fall into that it has earned a notorious reputation as one of the gravest mistakes investors can make.

Let’s break it down with some eye-opening numbers.

Imagine you’d invested $10,000 into the top 300 ASX stocks back in April 2000 and simply allowed it to simmer for 25 years until April 10th, 2025. Your patience would have yielded over six-fold growth, accumulating a whopping $68,303 total return.

Now let’s say you tried your hand at timing the market and missed out on just five of the best trading days during that period. In that scenario, your total return would have plummeted to $51,355.

You can see where this is going. The more often you trade out of the market, the worse your investment outcomes.

Miss the ten best days, and you’re down to a total return of $40,597.

And if you were unlucky enough to miss the top twenty days? Your total return falls to $26,916—a far cry from your original hopes.

So it’s crucial to understand that most of those stellar trading days happened amidst major downturns like the Global Financial Crisis and pandemic—times when fear was palpable, and many investors were poised to exit the market.

When emotions are running high, as they have been of late, it’s easy to let them dictate your financial strategy. But, more often than not, that leads to regrettable decisions.

Stay Vigilant & Stick with Your Plan

This doesn’t mean you should never make changes to your portfolio.

Rather, approach modifications to your investment strategy with a long-term perspective, targeting specific goals instead of knee-jerk reactions to market drops.

Remember that erratic investor behaviour dressed up as volatility often opens a door to great opportunities—and that you can gain a significant edge be recognising these opportunities for what they are.

So, how do you navigate this unpredictable market landscape?

While picking the exact bottom is almost impossible to do, history suggest that markets will eventually bounce back. Hence, rather than letting fear take the wheel, embrace volatility as par for the course.

When you commit to investing for the long haul, short-term downturns transform from harbingers of doom to mere blips on the radar.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Stick with the Golden Rule of Investing

The golden rule of investing is to ensure you avoid getting scared out of the market.

Patience pays dividends—literally. Those who stick to their investment game plan tend to fare much better in the long run.

So if you’re serious about generating solid long-term returns, remember that it’s just as essential to have the stomach for the ups and downs as it is to have a head for the numbers. As anyone who’s weathered a financial storm will tell you, stormy seas often lead to brighter days ahead.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.