Your Shortcut to Finding the Right Financial Adviser

Ankita Rai

Thu 1 May 2025 7 minutesFinding the right financial adviser isn’t always easy — especially when the financial decisions at stake are rising each year. With Australia on the cusp of a $3.5 trillion generational wealth transfer, the need for trusted advice has never felt more urgent.

According to the 2024 Australian Financial Advice Report by Investment Trends, more than 10 million Australians are now open to seeking financial advice — a number that’s steadily rising. But for many, uncertainty around adviser cost and access remains a barrier.

Even so, whether it’s planning for retirement, managing tax, or building long-term wealth, more people are starting to recognise the value of expert guidance — and the role it can play in securing their financial future.

So how do you find the right adviser — someone you trust and who understands your goals?

Here’s your shortcut to making a smart choice…

1. When Does Financial Advice Make Sense?

Before jumping in, it’s worth asking yourself: Do I really need financial advice right now?

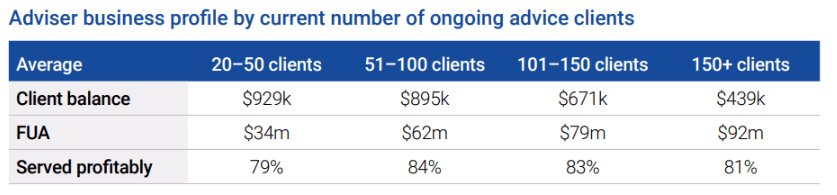

Financial advice can be a significant investment. Since advisers can only work with a limited number of clients — typically around 110 ongoing relationships — many set minimum thresholds for who they’ll take on. Some advisers focus specifically on high-net-worth clients, requiring a minimum income or asset base before offering ongoing services.

There’s generally an inverse relationship between the number of clients an adviser manages and the size of those clients’ portfolios.

So advisers who manage fewer clients (say, 20–50 families) usually work with wealthier individuals, with average portfolio sizes of around $929,000.

And advisers with larger client lists (over 150 clients) typically work with smaller portfolios, averaging around $439,000.

As a result, if your assets are on the smaller side, it may be harder to find an adviser — especially one geared toward long-term, personalised advice.

If you're earlier in your financial journey or your needs are simple guidance, budgeting tools, scaled or one-off advice, robo-advice might be a better place to start since it’s cheaper and easy to access.

2. Be Clear on What You Need Help With

Once you’ve decided to seek advice, the next step is knowing exactly what you need help with.

Not all advisers offer the same services — or even the same kind of advice. Some focus on retirement strategies, others on insurance or wealth transfers. Depending on your goals, that distinction can make a big difference.

You might be seeking guidance regarding buying a home, starting a family, or managing a financial windfall. Whatever the situation, being clear on what you need will help you find the right fit faster.

A good adviser will tailor their approach, and ideally, adapt as your needs evolve over time.

You’ll also want to consider whether you prefer independent or affiliated advice. Independent advisers typically offer a broader menu of products and fewer conflicts of interest.

Either way, transparency is key — ask upfront whether the adviser is independent or restricted, and make sure you’re comfortable before moving forward

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

3. Check Their Credentials

This one is non-negotiable. Always ensure any adviser you’re considering is fully licensed and qualified to give advice. Start by tapping into your personal network — colleagues, mentors, and friends can often be great sources of referrals.

In Australia, all licensed financial advisers must be registered with ASIC and listed on the Financial Advisers Register, where you can check their qualifications, history, and any disciplinary actions.

However, even if an adviser is qualified and comes highly recommended, it’s important to do your own due diligence. For example, there’s little point in seeing your friend’s adviser if you’re just starting out with $50,000 to invest and their expertise is in managing portfolios over $400,000.

It’s also worth reviewing their website for a Financial Services Guide and Adviser Profile, and checking platforms like Adviser Ratings for independent client reviews.

4. Understand the Costs

By now, you should have a shortlist of advisers. The next crucial step is understanding what their advice will cost.

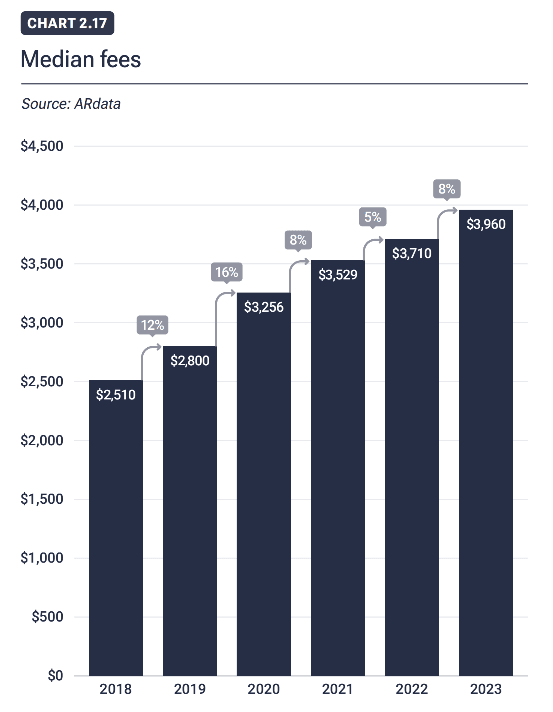

In Australia, the median cost of comprehensive financial advice is $3,960 — up 40% from five years ago.

Advisers use different fee models, so it’s important to ask for clarity upfront.

Some charge flat fees for a one-off project like preparing a Statement of Advice, while others use asset-based fees — typically 0.5% to 1% of your portfolio. Hourly rates are also an option, particularly for clients with smaller, one-off advice needs.

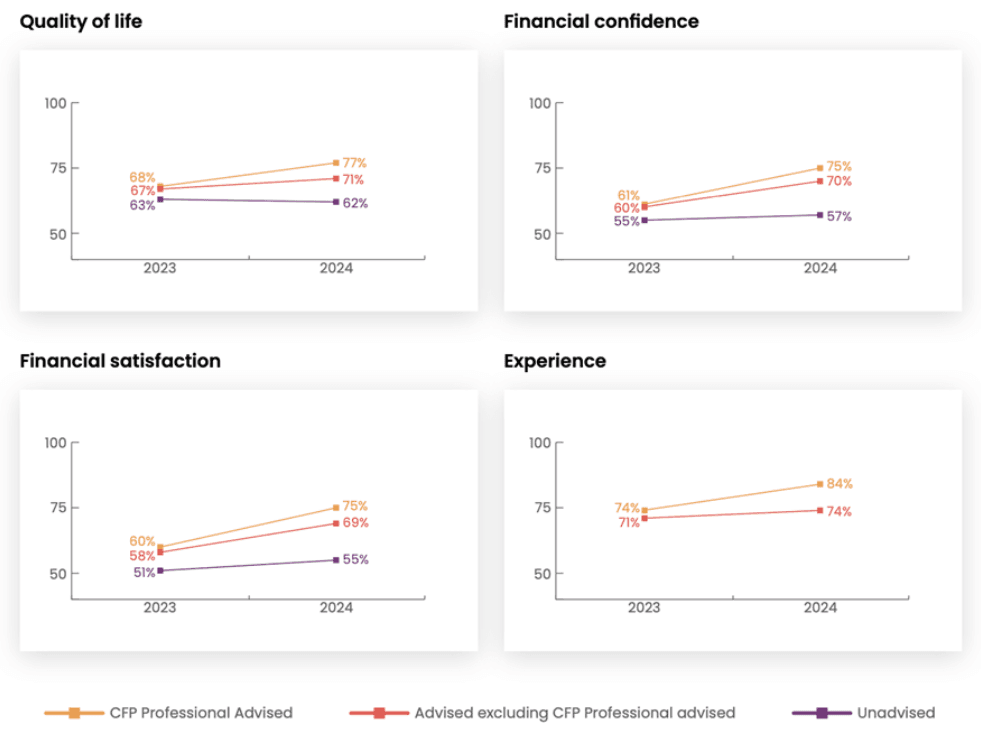

So, is it worth it? The 2024 Value of Advice Index suggests it is. Australians who receive advice report stronger financial confidence, greater life satisfaction, and more peace of mind than those who don’t.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

It’s worth highlighting that the cheapest adviser isn’t always the best. Always check what’s included in the fee, whether the relationship is ongoing, and don’t be afraid to negotiate. Transparency is key — know what you're paying for before you sign anything.

5. Trust Your Gut and Stay Informed

Trust isn’t something you can chart or calculate — but it’s critical when choosing a financial adviser. A strong advice relationship is built on real listening, clear communication, and genuine understanding.

In contrast, if an adviser talks over you or doesn’t take the time to hear your concerns, it’s a red flag.

Most advisers offer a free initial consultation. Use it to sense-check: Are they explaining things in a way you understand? Do you feel comfortable and confident? If not, trust your instincts and keep looking.

6. Stay Informed About New Advice Options

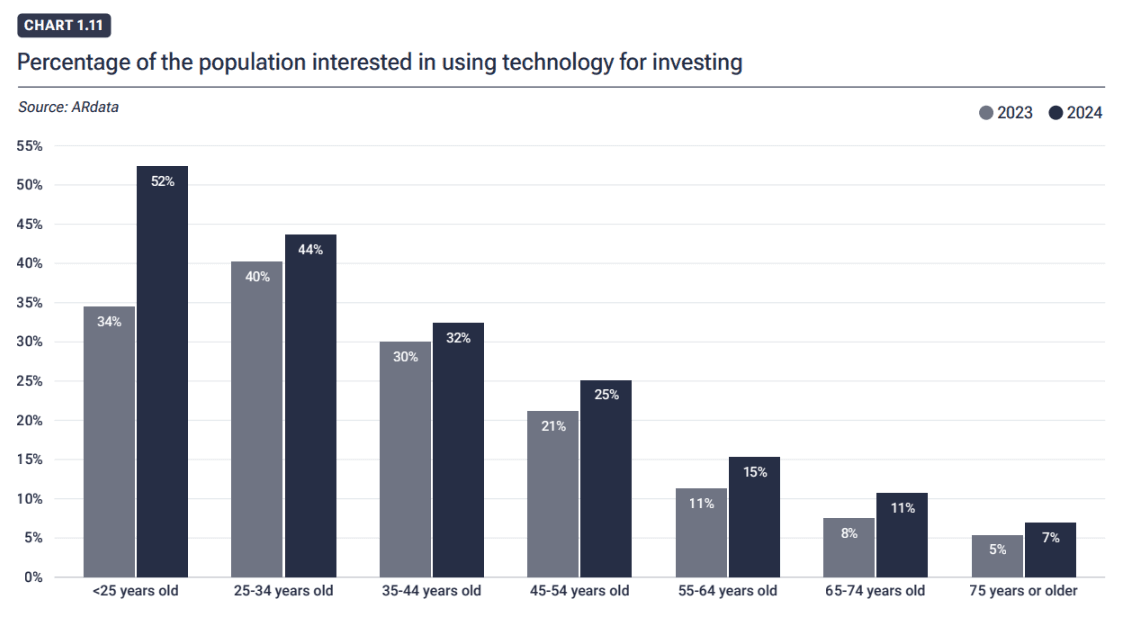

The financial advice space is evolving quickly. Robo-advisers and AI-driven tools are making personalised guidance more accessible — especially for those with simpler needs or smaller portfolios.

While less than one in three Australians currently use digital solutions to manage, invest, or trade their money, the intention to use these technologies is rising steadily — particularly among younger Australians.

That said, digital advice still requires the same level of scrutiny as traditional advice. Ask yourself: Does this sound sensible? Is it realistic? Is it too good to be true?

Digital advice isn’t a shortcut — it’s just another tool. And in areas like tax optimisation and portfolio diversification, it’s proving to be a very useful one.

Take Your Time, Find the Right Fit

Finding a financial adviser is one of those decisions that’s likely to shape your future in ways you’ll only fully appreciate later. Whether it sets the foundation for a long-term partnership or teaches you what to avoid, it’s a move worth making carefully.

For most people, the best approach is to stay patient, ask the right questions, and trust your instincts.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.