Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 0.42% | 1.3% | 5.8% | 5.79% | 4.65% | 4.33% | 5 Apr 2017 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.35% | - | 0.38% |

To invest directly and indirectly in a portfolio of cash, cash-style investments and other financial assets such as a range of short to medium bank term deposits, bills of exchange, promissory notes, bonds, fixed or floating rate debt securities as well as income securities and to enhance returns via exposure to the pooled mortgage portfolio of the Trilogy Monthly Income Trust.

| 1 Year | 5 Year p.a. | Since Launch (2017) |

| 5.65% | 4.55% | 4.28% |

As at 30 September 2025

Distribution rates quoted are net of fees, costs and taxes and assume no reinvestment of distributions. Past performance is not a reliable indicator of future performance.

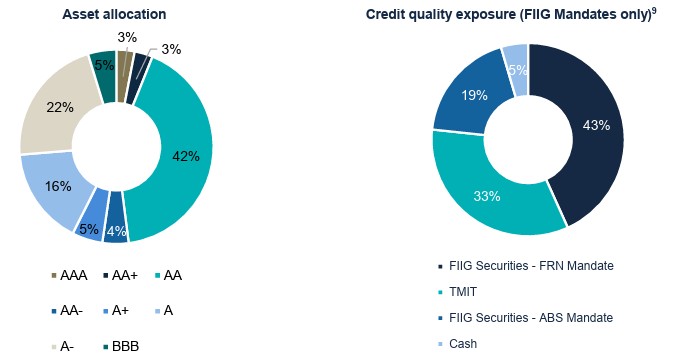

9 Only includes investments associated with FIIG Investment Management Limited (FIIG) (FIIG Mandates) in the portfolio.

As responsible entity for Trilogy Enhanced Income Fund, Trilogy Funds has developed protocols and policies for managing the risks involved with investing in our products. However, you should consider risks such as liquidity risk, diversification risk, risk of losing income, principal invested or a diminished return. See section 5 of the PDS for more details on these risks.

The Investment Manager, which is a Corporate Authorised Representative of Trilogy Funds, pays careful attention to asset allocation and managing liquidity of the Trust with regular monitoring of exposure to underlying fund managers and balancing of the portfolio.

Justin is Joint Managing Director of Trilogy Funds Management Limited and its parent company, Trilogy Funds Group. He joined Trilogy in 2007 as Chief Financial Officer and was appointed Chief Operating Officer in 2011, before moving into his current role as Joint Managing Director.

A Certified Practising Accountant, Justin has more than 30 years of experience in accounting and finance, including over 25 years in the financial services sector. He brings deep expertise in financial management, audit, technology, and strategic planning, and plays a key role in overseeing Trilogy Funds’ responsibilities under its Australian Financial Services License, including the operation of its managed investment schemes.

Justin’s strong command of statutory reporting requirements and governance frameworks has been central to the Group’s ongoing growth and operational performance. His leadership in implementing business-critical systems and process improvements continues to drive efficiency and support the long-term strategic direction of Trilogy Funds.

Henry is Joint Managing Director of Trilogy Funds Management Limited and its parent company, Trilogy Funds Group. Since joining the business, Henry has played a key role in shaping Trilogy’s strategic direction and governance framework, with a particular focus on regulatory oversight, risk management, and capital structuring.

Henry is responsible for overseeing the Group’s AFSL obligations and engagement with internal and external stakeholders. He works closely with internal teams to ensure that appropriate controls and governance measures are embedded across the business.

His work spans the origination and negotiation of a range of institutional-grade transactions and partnerships, both in Australia and internationally.

A core requirement of Henry’s role is to bridge risk, governance, and growth strategy to support Trilogy’s long-term success in managing retail investment products and fixed income assets.

Our Head of Lending Clinton Arentz is also Managing Director of Trilogy Finance and a Director of the broader Trilogy Funds Group. Since joining the business in 2017 as Head of Lending and Property Assets, he has been instrumental in driving the growth and strategic direction of Trilogy’s property lending platform.

Clinton led the nationwide expansion of the Trilogy Monthly Income Trust, supporting the growth and management of a construction loan portfolio now exceeding $1 billion. He also played a central role in the creation and scale-up of the Trilogy Industrial Property Trust, which has grown to over $250 million in assets under management across five Australian states and territories.

With more than 35 years of experience in propety development, project delivery, and asset management, Clinton’s expertise spans residential, commercial, and industrial sectors. Prior to Trilogy, he held senior roles with Jones Lang LaSalle and co-founded a business that reached the No. 1 ranking on the BRW Fastest Growing Private Companies list.

Clinton brings deep capability across the full development lifecycle—from risk assessment and funding strategy to project structuring, delivery, and asset realisation. He is also highly experienced in asset management, work-out projects, and disposal strategies.

Clinton holds an MBA from the Australian Institute of Business and has completed executive programs through the Securities Institute of Australia and the London School of Economics. He is committed to delivering practical, responsive finance solutions and long-term value for property developers across Australia.

Portfolio diversification is a risk management strategy that allocates investments across various asset classes, locations, industries, and other categories in an attempt to limit exposure to any one particular sector. With any type of investment, there may be periods when some investments don’t perform as expected. Portfolio diversification aims to minimise the impact of any one asset’s under-performance on your portfolio and typically achieves more consistent long-term returns.

All of our investment options aim to pay distributions monthly. Investors can expect to receive distributions on or around the eighth business day of each month, given funds are available.

Investors should note that past performance is not a reliable indicator of future performance and that risks include loss of part or all of your capital, income, or diminished returns.

Accepting loans on a first registered mortgage basis is a security measure designed to help protect lenders and investors from financial loss. Apart from Government charges, a first registered mortgage has priority over all other liens or claims on a property in the event of default.

The Trilogy Monthly Income Trust is a pooled mortgage investment, providing investors with exposure to returns available through loans secured by first registered mortgages over Australian property. This gives Trilogy the right to take possession of a property and sell it to recover funds should a borrower stop making loan repayments or otherwise fail to honour the terms of a loan agreement.

Tags

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.