How the Rise of Day Trading is Rewiring the Market’s Structure

Simon Turner

Wed 22 Oct 2025 6 minutesYou may have come across the unique breed of individual known as a day trader in your travels. Their numbers have been on the rise for some time now, so much so that they’re reshaping the very architecture of markets along with the notion of price discovery. What was once the province of nimble derivatives players is now having systemic ramifications across global equity markets.

From Valuation to Flows: A Price-Agnostic Turn

Most of us who’ve been investing for decades rather than years are focused on old-school investment concepts like valuations, management, and fundamentals.

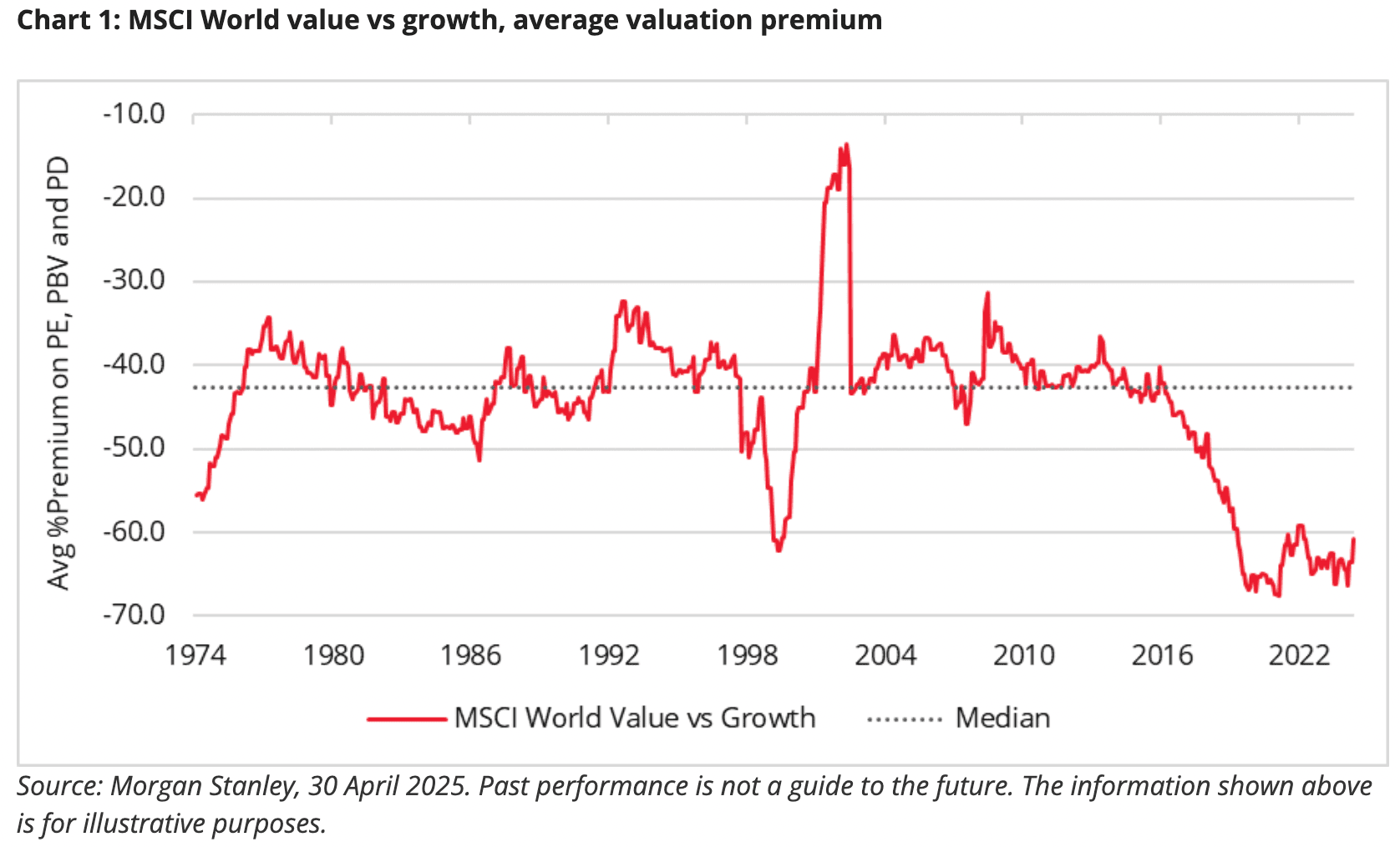

Not so for the ever-expanding population of day traders. Most are price agnostic and focused upon liquidity, momentum, even social sentiment. Rather than fundamentals, their trade decisions are largely driven by chasing flows rather than value.

This disaggregation between price and intrinsic value is in itself a structural break from the way things used to be.

Case in point: the gap between the cheapest and most expensive equities is at around a fifty-year high.

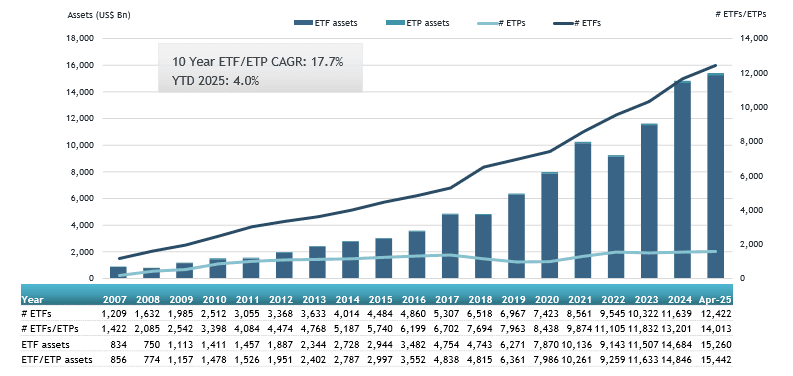

The inexorable growth of ETFs is further exacerbating this valuation-agnostic tilt. After all, when capital flows into index funds, it’s allocated without thought or discrimination.

No one is immune from the implications of what’s happening here. Even the large institutional players must grapple with order flow, trade microstructures, and execution tactics as integral performance drivers, rather than the incidental issues they used to be.

👉 Possibly the biggest implication is that markets are increasingly being driven by relative price movement rather than relative value.

Some old-school investors may argue that cycles come and go, and that fundamentals will one day rise from the ashes as the primary market driver. Maybe, maybe not. For now though, this is the reality investors need to navigate.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

High-Frequency Friction, Fragmented Liquidity & Smart Routing

Day trading in its algorithmic and high-frequency forms is front and centre behind this shift.

One of the main consequences is increased liquidity fragmentation across multiple trading venues and hence more complexity in execution. For many day traders, smart order routing systems have become essential as they break a single large order across multiple venues to seek the best execution path.

This trade fragmentation has introduced new frictions to markets in the form of latency, routing arbitrage, and queue priority that was largely invisible in more monolithic markets. Execution slippage, microstructure noise, and adverse selection now matter in ways investors historically ignored, or tucked away in their implementation cost buckets.

Moreover, the growing presence of algorithmic day traders means that order book behaviour is less inert.

Order cancellation, spoofing (posting and cancelling orders to shift perceived supply or demand), fleeting liquidity, and flash order tactics are more frequent as a result.

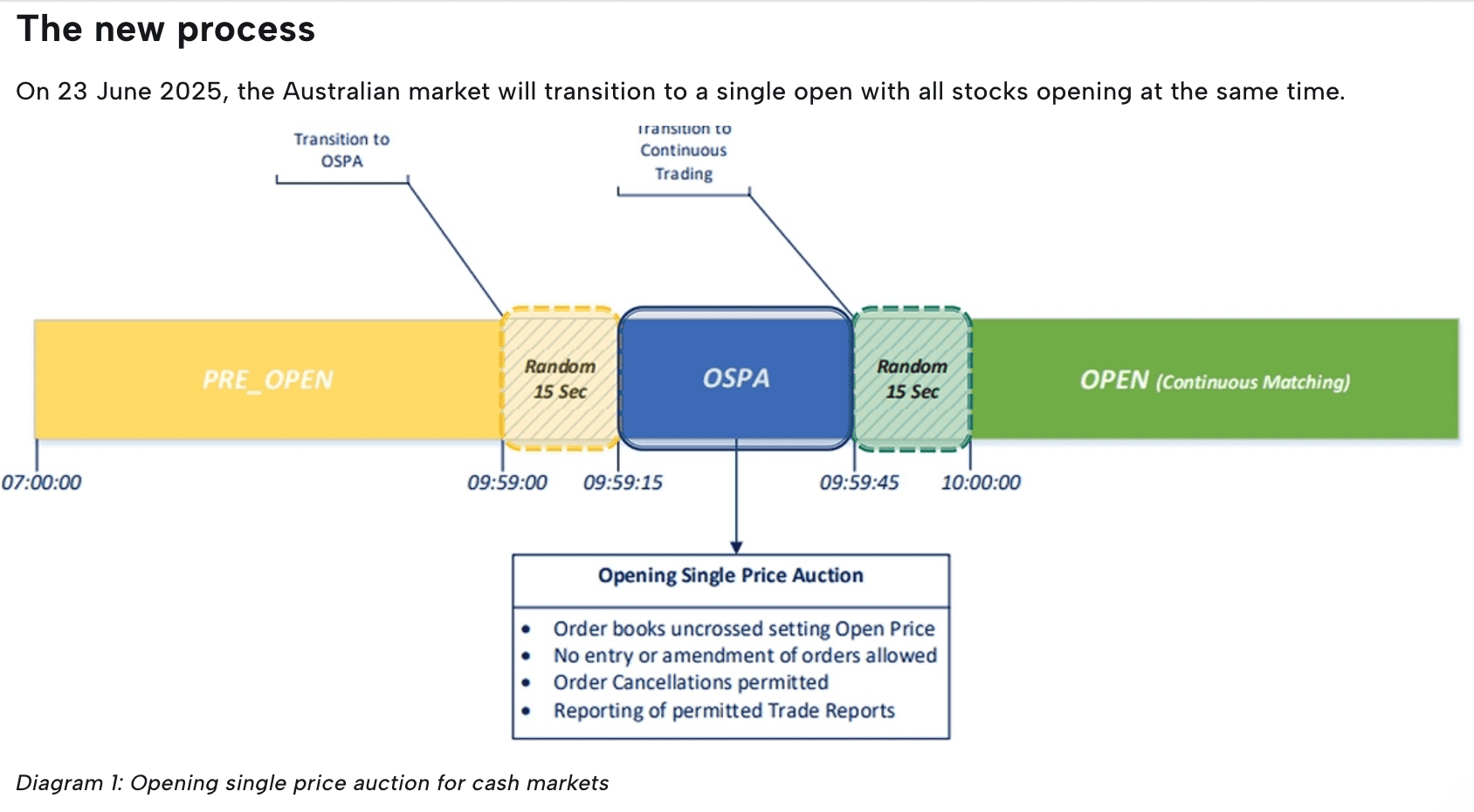

👉 The upshot is that global markets are more vulnerable to unexpected volatility flare-ups, particularly during opening auctions, macro news releases, and intra-session reversals. Microstructural jitter is increasingly muddying the waters which is degrading the signal-to-noise ratio for longer term investors.

Australian Context: Reform & Structural Change

Australia is not immune to these global currents. Indeed, there are uniquely Australian developments at play.

In June 2025, the ASX moved from a staggered-stock opening to a single opening auction for all stocks, a structural redesign to improve efficiency, transparency, and liquidity. That change reduced the frictions of staggered liquidity by compressing the pre-open matching process into a single event.

Simultaneously, the Australian market is facing intense scrutiny of its settlement and infrastructure. The RBA recently criticised the ASX’s settlement systems following a major failure, raising questions about its resilience in a world of more aggressive trading strategies.

Now Cboe Australia have been given the green light to operate a fully-fledged Australian exchange, the pressure on the ASX to keep raising its game is here to stay. That’s surely good news for investors.

Implications for Fund & ETF Investors

The rising prevalence of day trading demands investor awareness across four dimensions:

1. Execution as an Alpha Opportunity

Alpha is no longer purely about security selection. It is partly about how funds and ETFs execute their order books.

Smart routing, order slicing, latency arbitrage defences, and execution algorithms are becoming critical.

Indeed, in a market where day traders can pounce on predictable, slow-moving orders, stealth and flexibility in execution are nontrivial.

2. Liquidity & Tail Risk Recalibration

Post these shifts, traditional liquidity risk models (based on daily flows) may underestimate the risks of intraday flash events or flow squeezes. Stress tests must simulate short windows of extreme withdrawal or congestion.

ETF arbitrage mechanisms, in particular, must be stress-tested under the possibility of one-way flows driven not by fundamentals but by momentum or sentiment.

3. Portfolio Construction in a Noisy World

When short-term noise becomes a dominant driver like this, the timing of trades matters more.

So fund managers need to be more deliberate with their trade timing, possibly introducing short-term hedges or adaptive allocation buffers to cushion against microstructure volatility. They also need to know their exposures really well to ensure they can differentiate the noise from the fundamentals.

4. Active vs Passive Debate Shifting

Over the longer term, the shift toward price-agnostic trading is also forcing a revaluation of active vs passive strategies. In a world where broad flows dominate, the value of idiosyncratic, concentrated bets more typical of active management may increase, but so may the hurdle to capture them.

Translation: the value of active fund management appears to be trending upwards but picking the right active fund managers is more important than ever.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Speed, Complexity & Adaptation

The emergence of day trading as a structural force is not just a passing fad but a kind of tectonic shift.

It raises profound questions. Will markets increasingly resemble congestion-priced highways driven by tactical flows? Will fundamentals retain much power as signals when most participants trade off order flow and momentum rather than valuation?

One thing’s for sure: as the dominant trading agents become more opaque and bilateral, the market’s ecology will become more complex. That means investors need to adapt. Execution is no longer a back-office consideration. Liquidity is more fragile and dispersed. And structural reforms, like the ASX’s single open or scrutiny on settlement systems, may be necessary but not sufficient.

The funds who thrive in this new world will be those who combine intellectual rigor in stock/security selection with operational mastery in execution. They’ll embrace complexity rather than wish it away. And they’ll regard market structure not as background scenery but as an active battlefield.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.